Tesla stock continues its sharp fluctuations that have become usual this year, which investors in the electric car industry will not forget, as the stock is close to losing half of its value in 2022, after it received a severe blow as a result of Elon Musk’s acquisition of Twitter, in addition to other economic pressures. The stock market as a whole.

Tesla shares were subjected to other pressures last week, due to concerns about a production cut in the Shanghai factory, with slowing demand in China amid an increase in Corona injuries, and even other reports said that the American company was in the process of suspending the production of the Model Y in the last week of December, which is the best-selling model. I have Tesla.

Despite this, Musk's preoccupation with managing Twitter remains the biggest concern for investors. Will Tesla stock remain a victim of Musk's shift from the company, or has this step had enough of the negative impact on the electric car maker?

Tesla losses

Tesla stock ended trading on Wednesday, December 14, at the level of $ 156, recording weekly losses of more than 8%, which is the lowest level since November 2020, despite its rise by more than 3% in the last sessions of the week, to reach the market value at $ 565 billion, ranked seventh in the world, after it was Above $1.2 trillion during November 2021, when it formed its historic peak at $410

Since then, the red color has dominated its trading in Tesla shares, as the negative effects of the Federal Reserve's interest rate hikes on global markets in general coincided with Elon Musk's announcement of his desire to buy Twitter, which is the biggest factor in Tesla's losses this year.

Evidence for this is that Tesla shares have declined by about 53% since the beginning of the year so far, while the Standard & Poor and Nasdaq indices fell by 17% and 30%, respectively, which means that the negative impact of Musk's acquisition of Twitter was greater than the repercussions of raising interest rates and fears of economic recession.

* Tesla stock performance in 2022

The repercussions of buying Twitter

After disputes over fake accounts on Twitter were about to stall the deal, Musk completed his acquisition of the social media platform for $44 billion on October 27, after he sold at least $20 billion of his own shares in Tesla to fund the purchase, causing In strong losses per share, amounting to 23% since, compared to a gain of 3% for the Nasdaq index during the same period.

The matter did not stop at this point and it seems that it will not stop. With every decision that Musk makes regarding Twitter, Tesla investors fear that it will have a negative impact on the company's performance, even such as Musk's preoccupation with the social media platform more, which was evident in the past weeks, after he conducted The American billionaire made dramatic changes to the business and structure of Twitter.

Musk's policy towards Twitter and the content on the platform was met, especially by advertising companies that decided to reduce or withdraw their ads from the platform, as Apple did before returning again, after Twitter provided incentives to advertisers.

In light of the momentum of the changes that Musk is making, speculation has emerged that he wants to launch a digital currency for the Twitter platform, especially since he is one of the largest supporters of cryptocurrencies, which caused strong losses for the Dogecoin currency, because the issuance of the Twitter currency means that Musk will not be interested in official support for any other digital currencies. .

And with Tesla investors concerned about the length of time Musk spends on Twitter, the American billionaire went out to announce that he wanted to choose a new manager for the platform in light of his desire to reduce his working time within the social networking platform, which would be a strong impetus for the rise in Tesla's stock.

Tesla stock forecast

The possibility of Musk selling more of his Tesla shares to help fund Twitter remains the biggest risk to the electric car company's stock movements During the coming period, in addition to the economic pressures facing the industry in general, with high interest rates and inflation that hit production costs, which forced Tesla earlier in the year to raise the prices of its cars.

Amid these challenges, investors are betting on Tesla's ability to grow and achieve more sales as usual, with expectations that the American company will achieve a 55% increase in revenue for the current year as a whole, and another increase of about 39% next year.

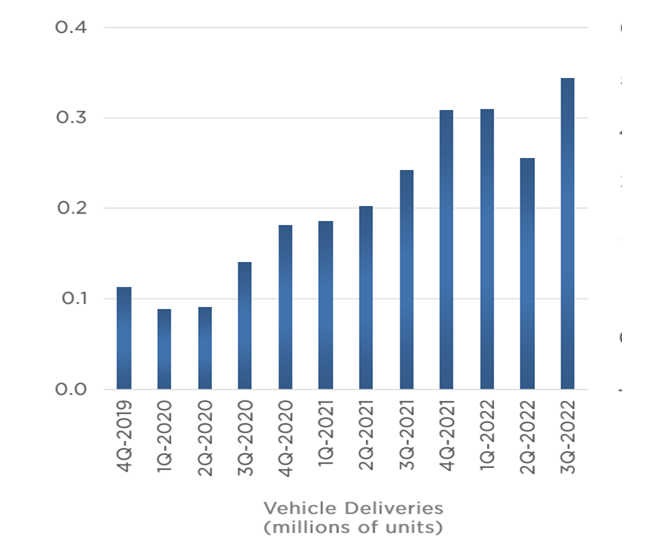

It is estimated that the delivery rate of Tesla cars increased to more than 440,000 cars in the last quarter of 2022, reaching a record level, compared to 343.8 thousand cars in the third quarter, bringing deliveries for the whole year to about 1.4 million units, to be less than what Musk pledged. At the beginning of the year with 1.5 million vehicles delivered, it is still a positive figure given the economic challenges and global supply chain constraints.

*Tesla cars delivery rate

Wall Street analysts forecast an average price target for Tesla stock at $278.43 per share over the next 12 months, representing an increase of more than 60% from the current level, but most keep the stock at a Neutral rating.

However, high inflation rates may lead to an increase in the costs of raw materials used in the manufacture of electric cars, which increases the final cost of cars and negatively affects the expected profitability of Tesla.

It should also be noted that there are many other challenges that may face the electric car industry and Tesla, such as the intense competition from other companies in this field and the lack of an electric transmission system sufficient to support many electric cars at the same time.

Technical view of Tesla stock trajectory

Last October 12, I presented a technical article entitled (The specter of losses haunts Tesla shares, so where is the target??) The share price was trading at $216. For many technical reasons, I expected the continuation of the downward path to reach the target of $150 and $108. Today, the stock is trading at $156.

Therefore, we had to update the technical vision for the next path and the expected targets. Technically, the stock is still under pressure from a group of bearish peaks and the double head and shoulders technical pattern, after breaking the neckline at $216 and moving away to the south, looking for its bottom. I think the stock is targeting $135 with the possibility of a drift. to 108 dollars, thus it is possible to recommend preparing to buy the investment stock within the previous levels

In the end, I believe that Tesla, with Elon Musk's technological ideas, is able to rise from the current humiliation of the knight with what it offers to humanity. Buying its shares may represent strong investment opportunities for the future, and perhaps all this noise that is raised around its founder is a personalization of the harbingers of success that raises competitors against him because he is simply different. He always thinks outside the box!!

Iyad Aref

Founder of the economic site Namazon