Bond market expert Bob Michel expects there is a 75% chance of a US recession over the next 18 months, but he believes the recession has been accounted for by the markets.

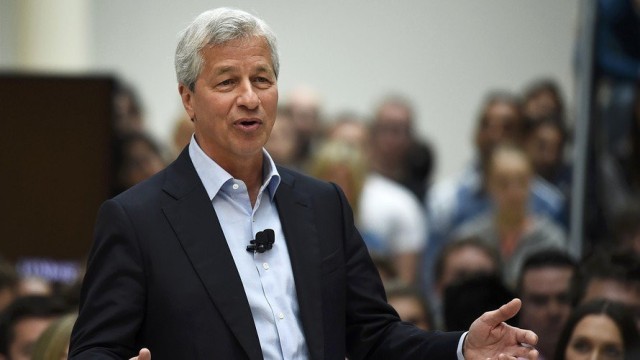

Customers are returning to the bond market, especially corporate bonds, and this is because they have renewed confidence in central banks, said Michel, chief investment officer at JPMorgan Asset Management, in a statement to Wall Street Week on Bloomberg TV.

Central banks around the world are aggressively raising interest rates in an effort to tame stubborn inflation, while trying to avoid pushing the economy into recession.

The European Central Bank raised interest rates this week for the first time in more than a decade. A Bloomberg survey of 44 economists conducted between July 15 and July 20 found expectations that the Federal Reserve will raise rates by 75 basis points again next week, then slow to 50 points in September.

With a recession forecast at 75%, Michel said that the market is now pricing somewhat in where he thinks the Fed should go. The Federal Reserve agrees. We're talking about a fed funds rate somewhere around 3.5% at the end of the year.

Erin Brown, director of multi-asset strategic portfolio at Pacific Investment Management, told Bloomberg TV that the stock market, which had its best week in a month, had not fully priced in a recession over the next year.

The market is setting base prices for stagnant growth, and I think it will be negative growth, she said.