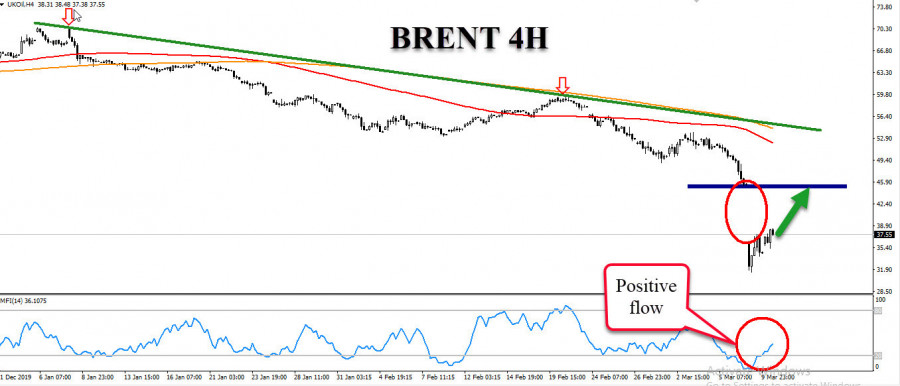

The expected scenario: Brent crude futures witnessed price collapses during the beginning of trading on Monday, after the OPEC meeting failed to agree to cut production again, with Russia indicating that it will leave its companies in producing oil without Adherence to any specific levels of production, which pushed the price of Brent crude to start trading this week on declines of 30%, to record Brent crude levels of $ 31.48, after last Friday's closing at $ 45.20 levels, so we are expected to witness a rebound wave higher on the way to close the price gap Down to the $ 45.20 levels.

As for the alternative scenario: If the price continues to fall, which is the least likely scenario at the present time, and break the support of 31.48 dollars, we will witness further declines to psychological support 30 dollars and then the 27 dollars over the course Short, given the current positive flow in the liquidity flow index, we tend to have a positive scenario with more hikes in the short term.

Expected general trend: bullish

Estimated traffic range: 37.50 to 45 dollars