Special Report - (Namazone):

Some analysts believe that the reaction of Gulf financial markets to these developments, may be exaggerated, perhaps more than the financial markets affected within the areas where the Corona virus poses a great risk.

>

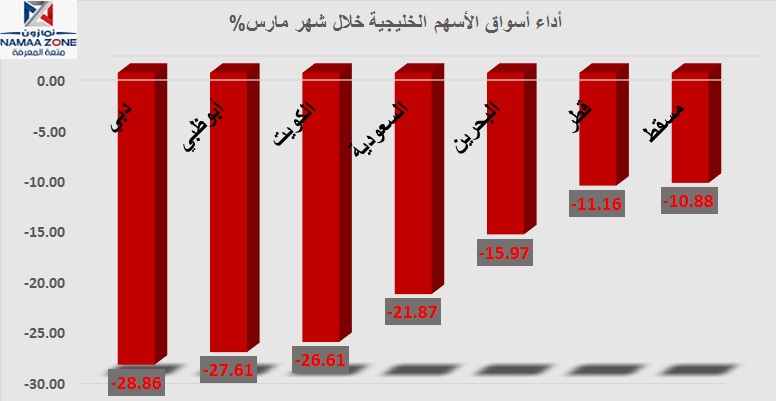

Dubai in front

The Gulf stock exchanges witnessed collective losses during the month of March, at the forefront of the UAE financial markets, especially the Dubai market, which recorded the highest losses, at the level of the Gulf region. The Dubai Financial Market fell 28.86%, with losses amounting to 747 points, from the beginning of the month of March until the end of the Monday session, March 16, to fall to the level of 1,842.6 points, compared to 2,590 points. At the end of February. Abu Dhabi Securities Exchange lost 27.6% of its value during March, equivalent to about 1353 points, and it came in second place in terms of the highest declines, reaching the level of 3,548 points, and it was The market ended the trading in February at the level of 4,901.42 points. The third position in terms of the highest declines, for the Kuwaiti Stock Exchange, which incurred losses amounted to 26.6%, to lose the general index of the market about 1616 points, in March, it fell to The level is 4,456.43 points.

pessimistic forecasts

NamaaZone " The Power of Knowledge"