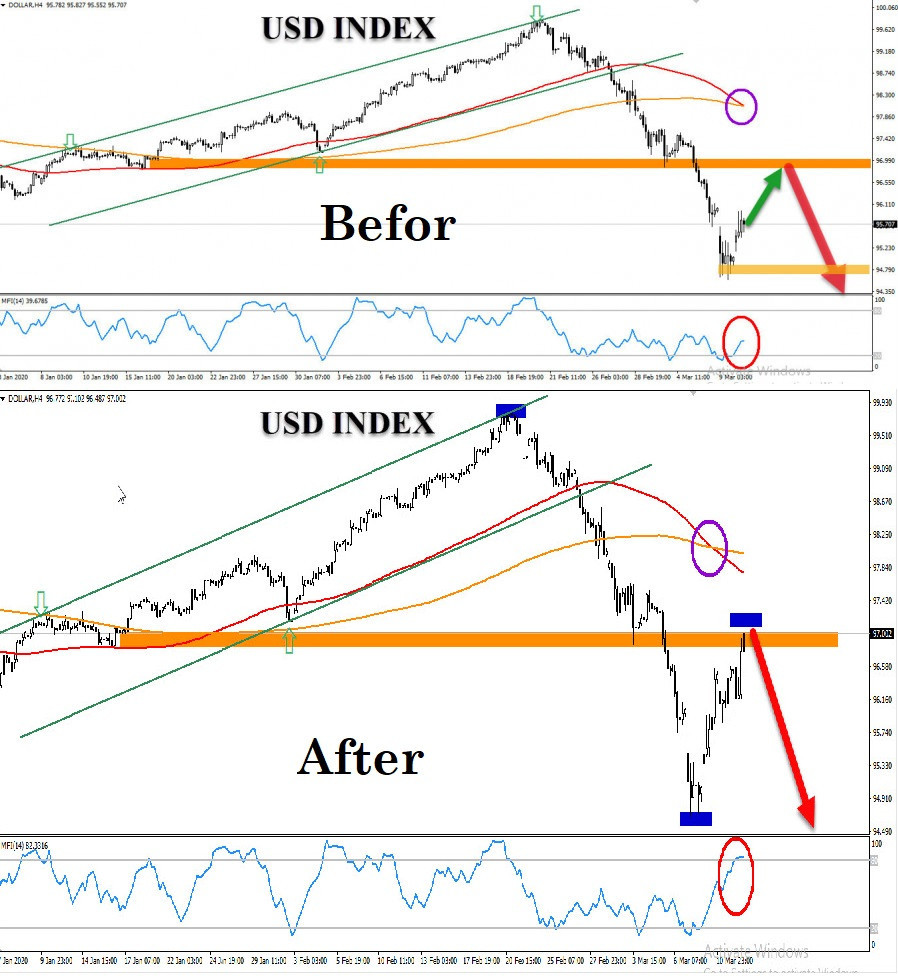

The expected scenario: We indicated in the previous report on the movements of the US dollar index to wait for more gains, to achieve the aforementioned price target dollar, at the 97 levels, and that at the beginning of the American trading today, Thursday, recording the highest levels It has a week, and the dollar index is expected to find price resistance at those levels represented in the strong offers area, so it is likely that we will see the end of the current corrective wave, and return again to the dips, to target the 96 levels and then retest the 94.50 levels. < / p>

Alternative scenario: As for if the price continues to rise, which is the least likely scenario at the present time, especially in light of the presence of the liquidity flow indicator at the 84 levels that represent high oversold areas, we will witness more gains In the dollar index down to 97.60 and then the 98.50.

Expected general direction: Downside

Expected traffic range: 97.50 to 95.60