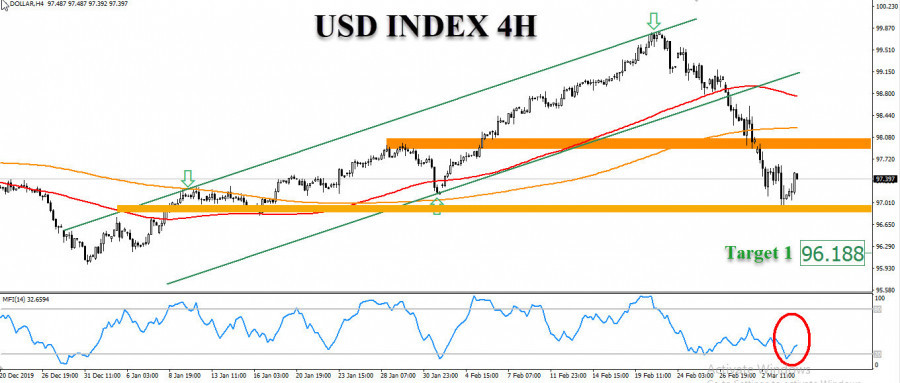

Expected scenario: The dollar index has witnessed strong declines during the trading of the past weeks, with a clear negative change in the general upward trend, to record yesterday the lowest level of nearly two months at the 96.85 levels, which formed support levels that worked on minor rebounds The dollar index is represented in strong demand areas, so the dollar index is expected to enter a correctional wave for the top targeting the 98 levels, and then return to complete the decline once again, reaching the 96.20 levels as an initial price target.

Alternative scenario: As for if the dollar index failed to consolidate above the 96.85 support, which is the least likely possibility at the present time, we will continue to decline down to the 96 and then 95.75 levels, in the short term.

Expected general trend: bullish (corrective).

Estimated traffic range: 97 to 98