have tech stocks reached the last station?

After weeks of continued gains and calm on Wall Street led by the record rise of tech stocks, a bout of volatility returned to the financial markets late last week, disrupting what It was almost a continuous climb to the US stock indices and raised questions about the path of Wall Street.

Just as technology stocks were the crutch on which the stock market relied to recover from the strong blow inflicted by the Coronavirus, the bad end of the overestimation and the bubble in which the technology sector is living in stealing the gains from the American stock market may be.

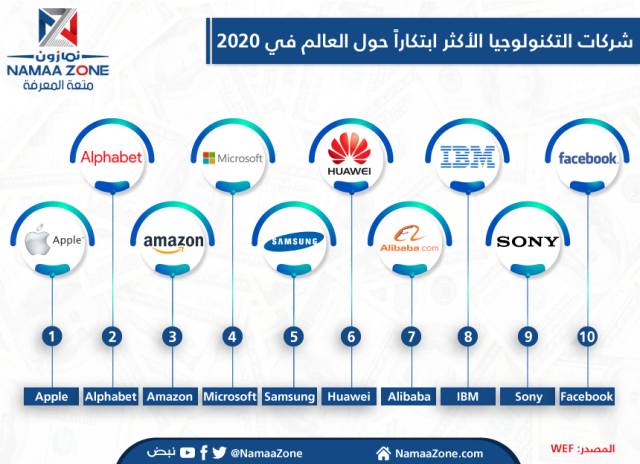

In fact, the record rise for the Standard & Poor's Index early last week was on the back of the gains of the American technology giants (Apple, Amazon, Alphabet, Microsoft, Facebook and Netflix), as during the past twelve months, the shares of these companies contributed to an increase of 74% of the market value gains of the broader index. Range.

But who pushed technology stocks and thus Wall Street to reverse their bullish path in the last 48 hours last week?

At the end of last Wednesday's session, all US stock indices celebrated strong gains with the rise of the S&P and Nasdaq indices, and the Dow Jones industrial average closing at the highest level of 29,000 points for the first time since last February.

This rise was after Standard & Poor's managed to record its best performance for the month of August in 34 years, with a rise of more than 7%, and the Dow Jones rose by 7.8%, the highest monthly increase since 1984.

In fact, record levels for US stocks during the weeks were mainly supported by the rise of major technology stocks led by Apple, Amazon, Microsoft, Facebook and Netflix, which benefited from people staying at home as part of the precautionary measures to combat the Corona virus.

But the situation turned upside down in the last two sessions last week after some saw that stocks were only heading higher, and technology stocks witnessed a selling wave in Thursday's session, so the Nasdaq index fell by 5%, and the Standard & Poor's fell 3.5% in the biggest drop. Daily since last June, while the Dow Jones lost more than 800 points, led by Apple, which collapsed by about 8%, its biggest decline since March.

* The performance of the Standard & Poor's Index since the beginning of the year *

US stocks also extended their strong losses during Friday's session, before shrinking them at ...