It seems that gold investors are not yet convinced that the Federal Reserve will soon stop raising interest rates, especially since the strong US jobs data may give way to continue the hikes this year.

Gold prices rebounded during the past few months and approached levels of 1950 dollars an ounce, and expectations increased about the possibility of achieving new highs this year, but in only one session the yellow metal fell dramatically, which indicates that the market did not reach complete certainty that the US Federal Reserve He will turn to stop the monetary tightening policy.

The US jobs report flouted the optimistic expectations of the gold market, after raising concerns that the Federal Reserve will continue to raise interest rates this year, especially since inflation is still far from target.

Gold price movements

Green dominated the performance of gold in 2023, after the sharp fluctuations it witnessed in the past year, as the yellow metal approached its previous peak and exceeded $ 2,000 an ounce last March, but then fell to its lowest level since April 2020 at about $ 1,650 in early November, before To recover in late 2022, ending the year with a slight loss of less than 0.1%.

The precious metal was exposed to a mixture of positive and negative factors. As the demand for gold increased as a safe haven in the aftermath of the Russian-Ukrainian war and its geopolitical and economic repercussions, at the same time, the large and continuous increases in US interest rates formed a pressure factor on the metal.

.

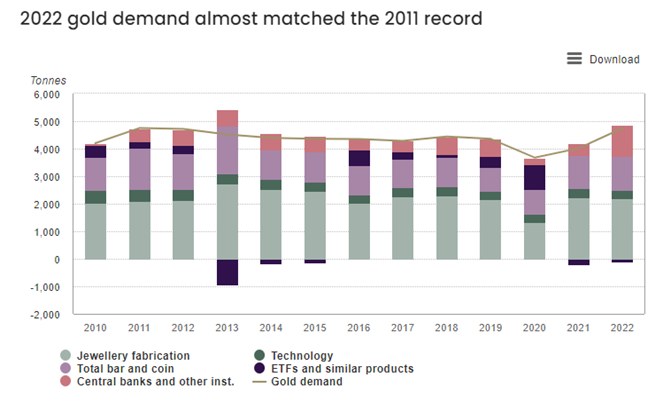

Global demand for gold rose by 18% last year to reach 4,741 tons, the highest annual total since 2011, after central banks boosted their purchases of the precious metal to a level not seen in 55 years, according to World Gold Council data, which is illustrated in the following graphic. :

Despite this, the Federal Reserve's policies and the subsequent rise in the US dollar and government bond yields negatively affected gold price movements, especially in the second half of 2022, before the Fed began reducing the pace of interest rate increases, with the yellow metal beginning its recovery journey.

The Federal Reserve raised interest rates 7 times last year; Including 4 consecutive times by 75 basis points, but it reduced the pace in December at 50 basis points, and in the first increase in the new year, it decided to raise interest by 0.25%.

Concurrently, gold took an upward path in the last two months of 2022, crossing the $1,800 barrier in December, and even jumped to its highest level in 9 months during the past weeks, crossing the $1,900 barrier, before US job data came as a curse on the precious metal.

Implications for the jobs report

The US economy added 517 thousand jobs last January, compared to 260 thousand jobs during the previous month, and more than expectations of 190 thousand, which indicates the strength of the US economy despite the Fed's efforts to curb inflation.

The unemployment rate in the United States also fell to 3.4% in January, a level not seen since 1969, compared to 3.5% in December, contrary to analysts' expectations of a rise to 3.6%.

The recovery in jobs would support the argument that the Federal Reserve may continue to raise interest rates in the future, which negatively affects the performance of the yellow metal, as it increases the opportunity cost of owning gold, which does not yield a return.

This quickly became evident last Friday, as gold prices fell at the largest daily pace since June 2021, by 2.8%, or the equivalent of $54.20, to reach $1876.60 an ounce, which is the lowest level in more than 3 weeks.

This decline pushed the precious metal to record weekly losses of about 2.7%, to reduce its gains since the beginning of this year to less than 2%, amid a strong rise in the dollar and US Treasury yields.

Investors raised their estimates on the pace of monetary policy tightening by the Federal Reserve following the jobs report, as they now expect by 83% to increase the interest rate by about 25 basis points at the next March meeting, to reach the range of 4.75% and 5%.

This corresponds with Federal Reserve Chairman Jerome Powell's statements that the US central bank is not considering stopping interest rate hikes any time soon, as it continues its efforts to fight inflation, but at the same time indicated that all options are available.

Gold price forecast

In general, expectations indicate that gold's performance this year will be better than 2022, with gloomy economic prospects in the United States and Europe, as demand for the metal increases in times of economic uncertainty, while the recovery of China's economy from the repercussions of Corona may raise consumer demand for gold. gems.

The International Monetary Fund believes that the US economy will grow by 1.4% this year, compared to a growth of 2% in 2022, while the euro area is expected to witness a sharp slowdown in growth, to record 0.7% in 2032, compared to 3.5% last year.

Despite this, the upcoming signals and decisions of the Federal Reserve will be the main determinant of the path of gold prices in 2023, especially since the recent jobs data made the decision to stop increasing interest rates indefinite so far.

Goldman Sachs believes that gold prices may rise to $ 1,950 an ounce this year, indicating that the reopening of China's economy and increased central bank purchases will support prices, especially since the country is the largest consumer of gold in the world.

For its part, JP Morgan expects gold prices to average $1,860 an ounce in the fourth quarter of this year, with expectations that the Federal Reserve will stop raising interest rates.

Technical Analysis

Returning to the technical battlefield between the forces of bulls and forces of bears, we notice a significant decline from the $1950 resistance level and a return to a bad weekly closing at $1864. Our technical vision expects gold prices to return to the investment buying range between the $1500 and $1450 levels. breaking 1725 will strengthen the bearish momentum for the movement

In the end, will the gold trend be subject to the Federal Reserve’s moves in 2023, as happened last year, or will economic concerns be the main driver to support the metal?

Iyad Aref

Founder of the economic site Namazon