(We saved our country’s economy), this is how Turkish Finance Minister Nureddin Nabati commented on the extraordinary economic measures taken by Ankara, to pull the Turkish lira from its lowest levels ever, which has already happened, but the Russian-Ukrainian war risks more challenges for the Turkish economy, especially Regarding the sharp rise in energy prices, the main element in the Turkish import bill!!

This coincides with a rise in the inflation rate to its highest level in decades; Central banks around the world are moving to raise interest rates, including the US Federal Reserve, which decided to raise rates by a quarter of a percentage point for the first time since 2018, and the Bank of England raised interest rates for the third time since last December from 0.50% to 0.75%.

Despite these challenges, Turkey continues to go against this economic orthodoxy, with the government arguing that raising interest rates actually exacerbates rather than tames inflation, as Ankara's plans work to bridge its current account deficit by promoting export-focused growth and stabilizing its currency from During the launch of the controversial Lira Deposit Protection Program!!

Despite this jump in inflation, the Turkish Central Bank kept interest rates unchanged for the third month in a row, at 14%, after a series of cuts last year, which caused a currency crisis and pushed the cost of living up significantly, as the inflation rate continued to rise higher Despite this, the Turkish Central believes that inflation is driven by high energy costs resulting from the regional conflict between Russia and Ukraine, but this increases Turkey’s trade deficit, amid a rise in oil prices by nearly 50% this year and its recovery above levels $100 per barrel.

In an attempt to boost economic growth in the wake of the pandemic shock, Turkish President Recep Tayyip Erdogan has put his usual pressure on the central bank to lower borrowing costs, which prompted the bank to cut interest rates by 500 basis points since September 2021, to settle at 14% last December.

The strange thing is that the inflation rate in Turkey at the time of the interest cuts was still less than 20%, which led to the collapse of the Turkish lira to an all-time low of 18.36 against the dollar, with a loss of almost 45% of its value in 2021, exacerbating consumer prices Already high due to Turkey’s dependence on imports, the Turkish government tried to take unconventional measures to counter the fall of the lira instead of raising interest, by encouraging the transfer of savings from other currencies to the lira, through guarantees the government pledged to pay to depositors to compensate for losses caused by the decline of the Turkish currency and protect Savings from exchange rate fluctuations

Certainly, these exceptional measures, along with fixing the interest in recent months, have contributed to sharply reducing the losses of the lira, to fall against the dollar from 18 to 10 liras within a few days, and to stabilize now against the countries between 13 and 14 liras per dollar, but the pressures of the Russian-Ukrainian war It pushed it back down around 14 pounds to the dollar.

Despite this, the situation with respect to the Turkish lira remains relatively stable, with the continued intervention of the Central Bank, which sells dollars and buys lira in times of turmoil in an attempt to support the local currency, and this is what made President Recep Tayyip Erdogan praise the recent period of calm witnessed by the Turkish lira, He described it as a sign that the economy is about to enter the strongest period in Turkey's history, but who is safe from the treachery of the current war?

In fact, as soon as the effect of the government’s measures to save the economy began to appear at the beginning of this year, until the Russian invasion of Ukraine put pressure on Turkey’s economy, as it threatens to increase the inflation rate, which in turn exacerbates economic challenges, especially since the World Bank estimates indicate that an increase Consumer prices of 1% in Turkey increase the number of poor by 2%.

With Turkey relying heavily on Russia and Ukraine to meet its needs, the government found itself in a new bind, with the two sides of the conflict among its main economic partners, in several sectors from tourism to energy.

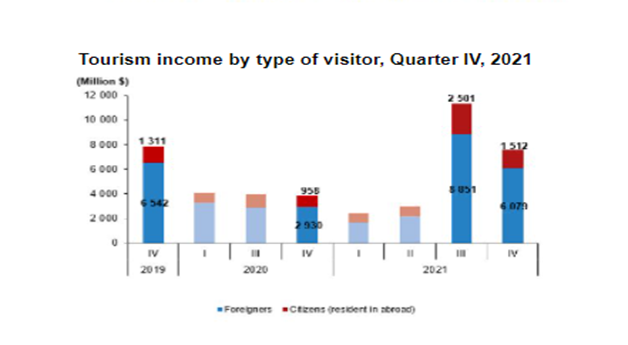

Indeed, for example in the tourism sector, the Russians and Ukrainians are among the largest foreign visitors to Turkey, and of course the ongoing war affects the flow of tourists from these two countries, threatening to lose a vital source of state revenue, and thus not meet Ankara’s goal of 35 billion dollars in tourism revenues. In 2022, after a huge jump last year that exceeded 100% to $24.5 billion, according to data from the Turkish Statistical Institute.

*Tourism revenue on a quarterly basis

In the energy sector, Russia is the main supplier to Turkey, as it meets more than 33% of the country's natural gas needs, and high energy prices will exacerbate pressure on the Turkish budget, which is struggling to reduce the current deficit, especially since Turkey has spent $51 billion on energy. last year.

No one denies that energy imports are the main constraints to the Turkish economy, as they put pressure on the budget, especially with oil prices rising above $115 at the moment, while some estimates indicate that every $10 increase in the oil price adds $5 billion. To Turkey's current account deficit!!

It will not stop there, as the Turkish economy will face other challenges in providing basic food needs, as Russia and Ukraine account for nearly 80% of Turkey's grain imports, which may push the country to search for other sources.

As for the expected technical movement, with the price of the lira trading today, March 23, near 14.80 dollars, we believe the opportunity is available to rise towards levels between 15.25-16.50 pounds to form resistance levels from which it is expected to return to levels of 12 pounds at the minimum.

With all these challenges, the World Bank expects the growth of Turkey's economy to slow to 2% this year, after growth of 11% last year, but in fact, the picture is still unclear with the continuation of the Russian-Ukrainian war, which may raise inflation more and more. The central bank then raise interest rates? While it had a pledge to either depositors of the Turkish lira to guarantee the value of the deposits against the dollar exchange rate!!