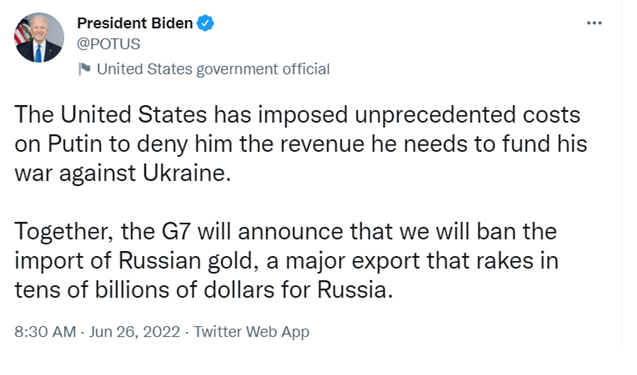

It seems that Western countries saw that sanctions against the Russian energy sector, which represents the backbone of Russia's economy, have not worked so far, especially since Moscow's exports found their way to India and China, so the Group of Seven major industrialized countries decided to impose a ban on the import of Russian gold in order to narrow Screw on government revenue, to stop the war in Ukraine.

Britain, Canada and Japan joined the United States in the decision to ban imports of Russian gold, which is Moscow's second largest export after energy. Will the yellow metal market be affected by this decision, as it happened to the oil market, and push crude prices to high levels that the whole world is currently moaning?

At first glance, you might think that the ban on Russian gold will activate the prices of the precious metal and push the prices up, as some investors expected, given the large weight of Moscow in the global gold market, being the second largest producer of gold at 330.9 tons after China, and the fifth largest country in the world with reserves. In the world, about 2,298 tons, and it exports 60% of its production, and 90% of these exports go to the Group of Seven countries, which took the decision to ban, but the devil lies in the details. In addition, the technical chart may have a different word from the opinion of the optimists party, which we will monitor in this article

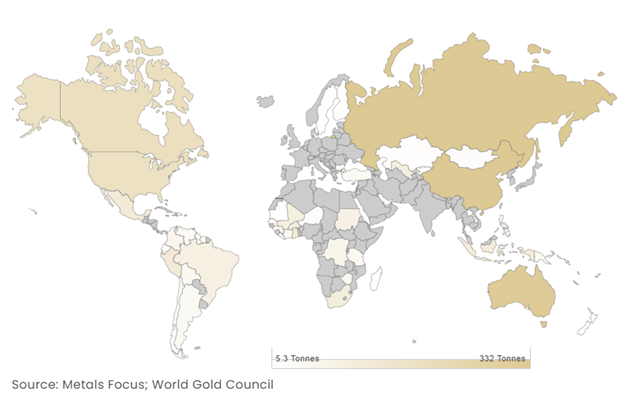

* Map of the Gold Forum in the world

Implications for gold prices

Gold prices achieved a slight increase of 0.5% during trading Monday (June 27), after the ban on Russian gold, before turning down 0.3% at the settlement, recording $ 1824.80 an ounce, but the metal continued to decline at the end of the Tuesday session at $ 1821.20, which is lower level in two weeks.

When reading the details of the decision to ban major countries from importing Russian gold, we will find that the penalties have been limited to newly extracted gold only, since the issuance of the ban decision, and do not apply to the supply of gold, which has already been extracted, and this explains the answer to a question, why the decision did not cause a shock Strong in the yellow metal prices?

Often, this matter is intended by the countries that imposed sanctions against Russia, in order to avoid causing a major shock to the markets that would harm themselves and their investors, as happened with the decisions to ban or reduce dependence on Russian energy imports, which raised oil and gas prices significantly, and was a major reason for accelerating global inflation.

The second matter, that the Russian gold ban was not surprising, as the markets began hedging a while ago from the possibility of making this decision, with the West’s goal clear from the beginning, which is to reduce the resources of the Russian economy, and then many Western entities and companies resorted to voluntarily reducing the purchase of Russian gold, This made the immediate impact of the sanctions limited.

The third thing is that the demand for gold by investors is weak at the present time, so reducing the Russian supply will not affect prices much, according to the dynamics of supply and demand, as the attractiveness of the metal as a safe haven and store of value has declined despite the tensions of the Russian-Ukrainian war and fears of stagflation, due to the tightening. Strong monetary policy by the Federal Reserve, to curb inflation.

The US central bank raised interest rates by 0.75% at its last meeting, in the largest pace of increase since 1994, after two consecutive increases by 0.25% and 0.50% in March and May, and this would enhance the protection of the dollar as a safe haven, and raise the opportunity cost of holding The yellow metal, which does not yield.

What explains the impact of this, is the negative performance of gold prices since the beginning of the year and its decline by about 1% in 2022 so far, despite the fact that the yellow metal rises in times of economic and political uncertainty, and more so at the present time, after the Russian invasion of Ukraine and the specter of economic recession .

* Gold price performance in 2022

The repercussions for the Russian economy

Just as the ban on Russian gold is seen as having a limited impact on the price movements of the yellow metal, the same may be for the repercussions on the Russian economy, at least in the near future, especially since Russian exports to the West have already declined.

So far, the Russian economy has avoided a devastating collapse, despite successive sanctions from the West, thanks to increased interest rates and capital controls, in addition to searching for other markets that buy Russian energy exports, the country's main source of revenue.

As for gold, the high demand for the metal from the domestic market reduces the repercussions of its ban in international markets, as billionaire businessmen in Russia buy gold bars in an attempt to mitigate the impact of Western sanctions.

In addition, the Russian Central Bank is buying domestically produced gold, which is seen as a way to help support the currency and the economy, to boost its holdings of gold reserves, which are currently estimated to be worth between $100 billion and $140 billion.

In addition to the strength of domestic demand, Russia will not struggle much in finding alternative markets for its gold exports, such as oil, especially since it offers a large discount compared to world prices, and here it can buy India, China and Turkey, especially since these countries are among the largest importers of gold.

Technically

As in the above technical chart, gold is still under pressure after the formation of the March 8 peak at $2070 an ounce, with negative technical patterns forming, as well as the presence of negative revelries on the weekly indicators, especially with the continuation of trading below the 200-day average for prices and even approaching the negative intersection of the 50-day average.

And with today’s trading Monday, July 4th, at a price of $ 1805, we believe that the declines will continue to reach the $ 1690 level over the next few weeks, and by breaking it, it will target a return to the investment buying range between $1,500 and $1,453, which we expect to visit at the beginning of 2023, which in our opinion represents an appropriate opportunity to enter Investors, especially those looking to hedge against the global inflation problem

In sum, the ban on Russian gold will not have a significant impact on the long-term expectations of metal prices in terms of the rise, as was believed by some of the continuators, especially in light of the technical pressures on the price movement. The short term on the other hand, and the West should think about avoiding Russian gas, more than any other commodity, in case it desires to deal a fundamental and strong blow to the Russian economy.

Iyad Aref

Founder of the Namazon website