Yesterday, August 17, the digital currency market was exposed to a large selling wave, during which Bitcoin lost nearly 10% of its price, to fall from the level of $28,700 to $25,700 in a liquidation process that exceeded one billion dollars. In this report, we will examine the most important declared and hidden reasons for this unusual decline. We will also discuss the reality of the artistic movement and the expected next path, which is the stallion

In terms of the fundamental analysis of this event, there are many possibilities that circulated in the markets during the last hours, which made the markets shake with such intensity and panic.

At first, the eccentric billionaire Elon Musk sold some of his holdings of Bitcoin belonging to SpaceX at an amount of $373 million, which opened the door to speculation about the reasons and motives and whether the sale process will continue, as the market later interpreted it negatively until Jacob’s breath. We will stand on its interpretation later.

In addition to the Chinese real estate giant, Evergrande, applying for bankruptcy, which raised the concerns of the Chinese whales about the consequences that this crisis will create on their business, so they liquidated some centers to preserve liquidity.

At the same time, there is positive news about the SEC approval to launch the first Bitcoin ETF fund, and it is also nice to start hearing unique news about Ethereum that also talks about the imminent approval of launching its own ETF fund next October, but the markets ignored this news, so what really happened? ? What is the real reason behind this sharp decline?

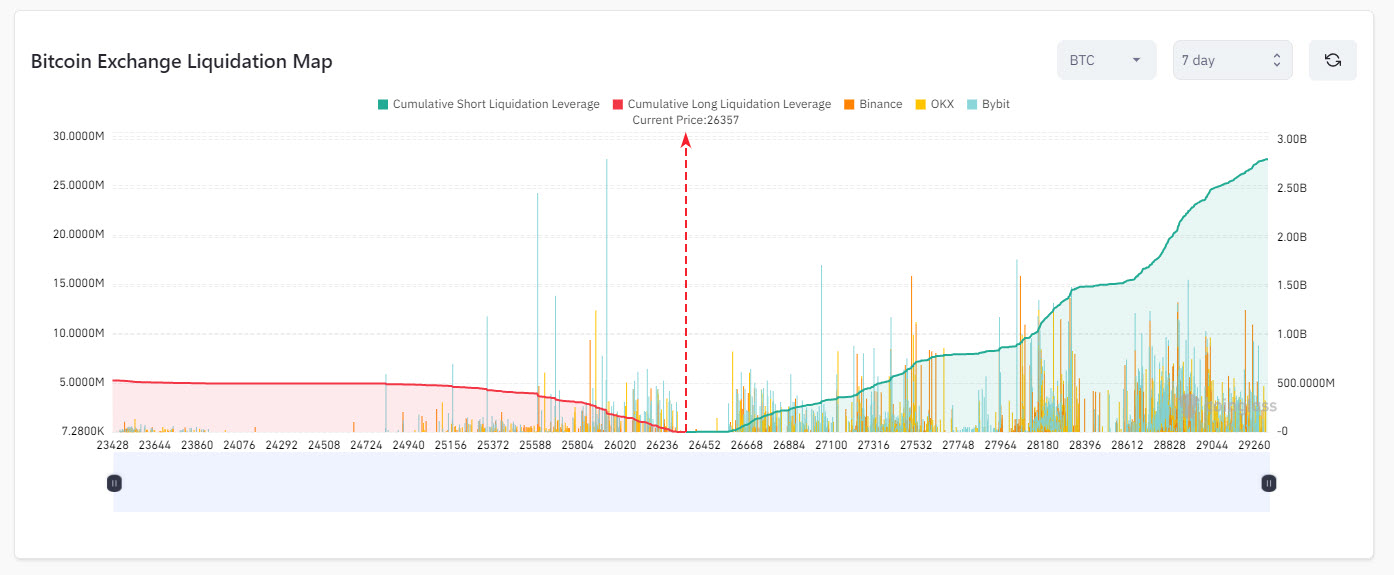

In my opinion, what happened is whaling for people’s greed and wrong bets. Please see the attached pictures that show the closing of open positions for contracts, or what is known as the Likudishine, with leverage bets of 10, 50, and 100 times. The numbers will show us that during the previous day the closing was done. More than 176,000 centers lost $1.04 billion as a result of the bets, as well as for the chart to record the largest liquidation process in several months, which is the whole point of what really happened.

There are important points that I think should be considered. The attached last chart shows the presence of approximately $2.8 billion in open buying positions that can be liquidated if the price of Bitcoin falls to the level of $23,428.

The million dollar question, has the bullish phase of the market ended and we will go back to the search for new bottoms??

This is what technical analysis and my technical vision of the path will answer, and the direct answer is, no, God willing

Before commenting on the current technical movement and updating the analysis, I must go back a little bit to my general vision of the market. In December 2022, I had published a lengthy article entitled (Bitcoin to 90,000, so are you ready for the journey and who is the winning horse?) At that time, the price of Bitcoin was in the range of $16,800. Investors are controlled by fear and anxiety as a result of the horns of shakers looking for bottoms, but our technical vision is correct, thanks to God, and Bitcoin has returned above 31 thousand, and the numbers will take over in the coming months until we climb to new historical peaks. If my technical vision of the general trend is upward, God willing, despite the current bumps, I find that Bitcoin formed a solid base for this trip in November 2022, near the $15,500 level, and the old chart was raised as a reminder.

With today's trading August 18th

Bitcoin stands at $26,350 and Ethereum is trading at $1,680

Technically, the reasons for the violent decline yesterday evening is the breaking of the bottom of the ascending channel that was established since the end of 2022, which brought Bitcoin to $31,800 and Ethereum to $2,140. Breaking the upward path means, for me, the end of a (wave) phase and the beginning of a new (wave) phase, so I renumber Waves for each stage of the previous ascent to monitor where the market might stop, as in the attached charts

In my belief, Bitcoin has made its first bullish wave from the bottom of $15,500, and it has now begun its correction phase, which I think chronologically will continue until the beginning of next October, so we have almost 6 continuous weeks ahead of us. Pressure should be expected until we approach the bottom, which I think will be near 23,600. Dollars, and it could reach $21,600, for the second wave to end, and then start again to break through the 32,000 level and launch to more bullish targets.

As for Ethereum, relatively speaking, I think its situation is different. Actually, it may achieve a hall earlier and start the breakthrough before Bitcoin, to lead the market in the next trip, and it is a big betting asset, so I described it as a winning golden horse. In the short term, I think that the current correction may extend to the $1480 level or a limit. Maximum 1300 dollars, then we start again and lead the next scene amidst the astonishment of the observers

My recommendation to you, my friends, if you have the liquidity now is the last time to adjust the positions or enter a new one, but if you do not have the liquidity, then you do not have to worry, stop the screens and enjoy the summer vacation with your family and come to talk in the coming November and December, you will find, God willing, the green color covered with watercress your wallet

If you like what we write, do not forget to participate in publishing the article so that my message reaches the largest number of people and benefits them. May God reward you with all the best.

May God bless everyone

My best wishes for you success

Iyad Abu Aref

Founder of the economic site Namazon