Recently, inflation concerns have become more prominent after the Corona epidemic crisis called for an exceptional and unprecedented response to the concerted efforts of all governments and global central banks, making expectations of a return to inflation more likely For many

However, investors are concerned about a price deflation occurring. This may sound a bit strange, given that fear of the opposite command has attracted attention and raised the prices of assets such as Gold

We review below the two possibilities that economists fear will happen: hyperinflation and price deflation.

inflation horror

What is meant here by inflation is the rate of price increase from a target level that often revolves around 2% in advanced economies, a rate that most monetary policy makers think is appropriate to support economic growth Throughout the past years, inflation has been an unattainable dream for central banks, despite all the attempts.

During 2020, central banks and governments pumped record amounts of money into their economies to fight the global recession caused by the Coronavirus pandemic, to inflate, for example, the Federal Reserve's balance sheet of 4 Trillions of dollars in mid-March to nearly $ 7 trillion, on top of that Congress has approved trillions of dollars in additional stimulus coming on the way.

But these strong measures by central banks are, in fact, a double-edged sword and have sparked speculation by many analysts that inflation has become a threat soon, but this time the conversation was not related to With benign inflation that supports growth, but rather hyperinflation that threatens the purchasing power of consumers and destroys the real value of money and deteriorates the economy.

by printing more money the quantity of goods does not change, however, individuals will have more cash to spend on these goods, and with more money they seek To obtain the same quantity of commodities, firms will naturally increase prices as a result of higher demand, which may ultimately lead to inflation.

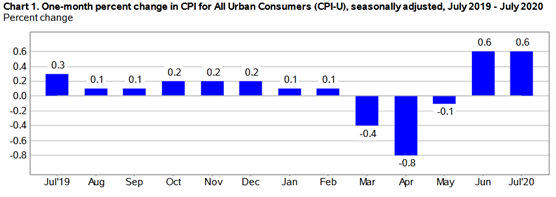

So far, weak demand has led to price contraction in advanced economies, as US consumer prices fell for three consecutive months before rebounding in June and July with signs of a recovery in demand. Consumers indicating the potential for billions of dollars to lead to hyperinflation after the crisis ends.

* US inflation performance in a year *

in response to some question that the stimulus measures during the financial crisis ...