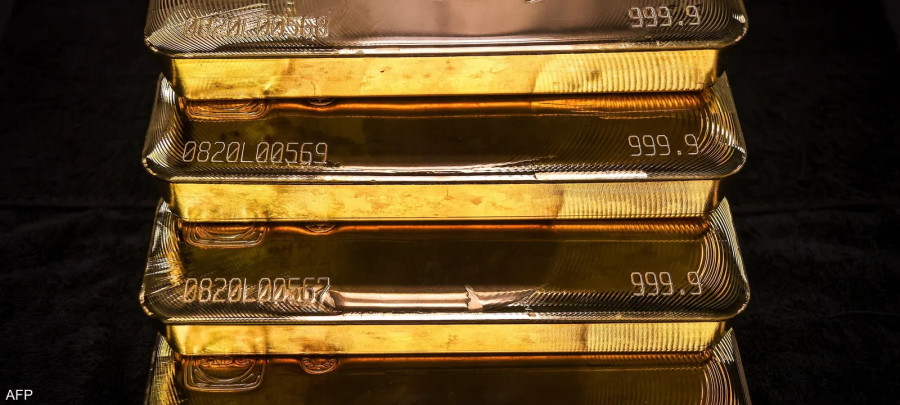

Gold prices rose with increased demand for it as a safe haven after the escalation of tensions in the Middle East following clashes between Israel and Hamas.

The precious metal rose by about 1.2% in early Asian trading on Monday, as markets braced for headwinds and volatility resulting from the major attack that took place on Saturday by armed elements in Gaza on Israel.

Gold began to rise on Friday after last week approaching its lowest levels since March, when it was affected by signals from the Federal Reserve that it will keep monetary policy tight for a longer period, coupled with rising US bond yields that pressured assets that do not provide interest to investors.

Gold rises despite headwinds

Monday's gains in gold come despite a rise in employment rates in the United States in September, which reinforces expectations of another increase in interest rates. At the weekend, Federal Reserve Governor Michelle Bowman said US inflation was still too high and added that further monetary tightening would likely be needed. Higher interest rates are generally negative for gold.

A sharp decline in the Tel Aviv Stock Exchange after the confrontations between Israel and the Gaza Strip

The spot price of gold rose 0.9% to $1,848.83 per ounce at 7:25 am in Singapore, after rising 0.7% on Friday. The Bloomberg Dollar Spot Index rose 0.1%. While silver prices rose, platinum and palladium declined.