Finally, the curtain came down on Elon Musk’s purchase of Twitter, ushering in a new era for the social media platform, and Twitter’s TWTR stock leaving Wall Street after 9 years of listing, after quick rounds of negotiations that did not last two weeks, leaving the company’s board of directors with no choice but to agree to the takeover offer. And the lifeguard mask

Now that Twitter is in the grip of the world's richest man, will something change in the social media platform, or will Musk want to buy in order to satisfy his craving for control? And does the American billionaire really want to make Twitter the largest platform for freedom of expression!! In return for paying $44 billion!!

In fact, the story of the acquisition was quick, but it was full of successive events, with which the company's stock interacted positively and achieved strong gains, so what happened in the past days? But is Twitter worth the amount paid by Musk, despite the losses of the years 2020 and 2021? What about profits, revenue and future expectations? All of these questions, we will try to answer in the following lines.

Beginning of the story

News of Musk's desire to buy Twitter surfaced publicly this month, but the American billionaire seems to have been thinking about it for a while. Musk had been buying shares in Twitter since late January, until he announced in early April that he had become the largest shareholder in the American company, with a 9.2% stake, valued at more than $3 billion.

At this time, Musk initially agreed to take a seat on the company's board of directors, capping his investment to a 14.9% stake, before Twitter CEO Parag Agrawal announced that Musk had decided not to join the board.

Musk was silent regarding any matters related to Twitter, until he announced his desire to buy the social media company, on Wednesday (April 13th), indicating that he wanted it to be a platform for freedom of expression, and it needed to turn to a private company to achieve this goal.

According to the US Securities and Exchange Commission, Musk offered to acquire Twitter for $54.20 per share in cash, worth $44 billion, which represented a 38% premium over the closing price on April 1, the last trading day before Musk revealed that he had become the largest shareholder. On Twitter, a premium of 18% over the closing price on Wednesday, at which the American billionaire announced the takeover offer.

Uncertainty reigned over the offer within Twitter's board. Although it was compared to a book value per share of $9.1 at the end of last year, accepting an offer to sell the company's shares was about 30% less than the share's all-time high of $77.06, which His record in February 2021 is a tough one.

In order to secure its position before considering the offer, the board of directors adopted a defense plan that would allow the company to issue new shares that all shareholders except for Elon Musk can buy at a low price, and under this new plan, Twitter will impose heavy penalties on anyone who acquires more than 15% of the company's shares. Without the approval of the Board of Directors, this is intended to protect the rights of shareholders in the face of coercive and unfair acquisition strategies.

new era

Despite the previously settled conflict, Twitter acquiesced to the offer of the American billionaire, to announce yesterday, Monday, April 25, that it had agreed to a final agreement to be acquired by Musk at a value of $ 44 billion, with the company being converted to a private entity after the completion of the purchase process, which is expected to be completed this year, subject to the approval of shareholders. and receiving regulatory approvals.

Twitter, in the words of its independent chairman, Brett Taylor, said that Musk's offer provides a significant cash bonus and is the best option for shareholders, after the company conducted a deliberate and comprehensive process of evaluating the proposal with a deliberate focus on value, certainty and financing.

Regarding funding, which was one of the reasons for the Twitter board of directors’ concern in accepting the offer, Musk announced that he had raised more than $46 billion to fund his bid to buy Twitter, including $25.5 billion by borrowing, and would commit $21 billion of his own money.

Faced with this, the question arises, why is Musk putting his money into a platform that faces scrutiny for content, hate speech and misinformation, as well as challenges of how to increase the number of users again, or does he want to satisfy his craving for control and strengthen his personal brand with 84 million Follow on Twitter.

To make sure that the world's richest man, whose fortune exceeds $270 billion, the president of Tesla, and the owner of Space, did not use his money to buy Twitter only in order to acquire, Musk outlined the future of the social networking company by adding new features and making the algorithms open source. To increase trust, get rid of the accounts of programmed publishing bots, verify people's accounts, and support everything related to freedom of expression.

Twitter co-founder Jack Dorsey, who stepped down as CEO last year, appears to have a lot of faith in Elon Musk to lead the company on the right path, noting that Musk's goal of creating an utterly reliable and broadly inclusive platform is the right one. .

Twitter's financial performance

In the midst of all this, does what Musk will pay match the financial performance of Twitter, which has made losses in the last two years in a row, 2020 and 2021?

In fact, the profits of the social networking company have been lackluster in the recent period, as Twitter announced annual profits during 2021 from losses of 221 million dollars, although it managed to reduce losses that amounted to 1.13 billion dollars in the year of the epidemic 2020, but this compares with annual profits amounting to 1.4 billion dollars in 2019.

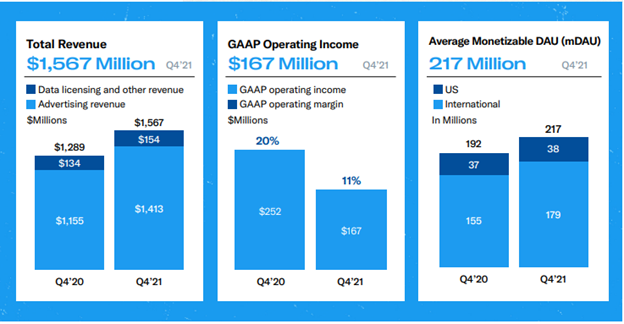

As for revenue, it increased to $1.56 billion in the fourth quarter of 2021, compared to revenue of $1.28 billion, in the fourth quarter of 2022, with the number of daily active users increasing to 217 million, compared to 192 million in the same period of 2020.

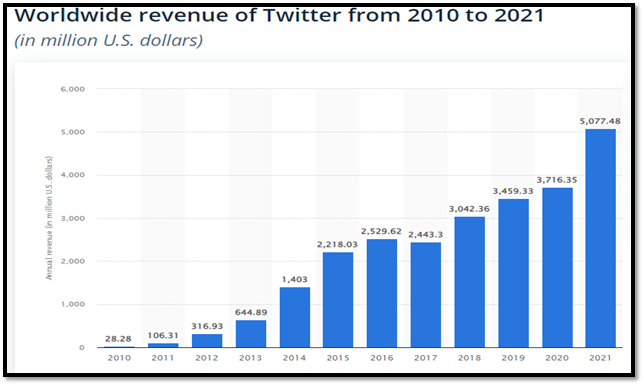

In total 2021, Twitter Inc.'s revenue increased to $5.07 billion, compared to $3.71 billion in the previous year; It has taken an upward trajectory since declining to $2.44 billion in 2017, as Statista data shows in the following graphic.

The American company confirmed that it is confident that revenue will continue to grow in the range of 20% this year, and it wants to achieve sustainable revenue growth that will push it to at least $ 7.5 billion next year, with a target to increase the number of users to 325 million daily users.

stock performance

Twitter's stock reacted very positively even before speculation that Musk would take over the company became a reality, as it rose by about 18% since the beginning of this year, until Monday's session, to reach $ 51.70, which is close to the price of the offer submitted by Musk, which amounted to $ 54.20 per share).

These gains pushed the market value of Twitter to close to $ 40 billion, and this is compared to the value of Musk's offer of $ 44 billion. Is the social networking platform, which is not in the list of the 100 largest companies in the United States that is led by Apple, is worth it.

* Twitter stock performance since 2020

For further clarification, Twitter’s stock jumped by about 6% at the close of yesterday’s session (April 25), following the company’s official announcement of its approval of the takeover offer submitted by Musk, to be at its highest level since last November, which confirms that the decision to sell the company is favorable to investors. , Hoping to recover the platform from the difficult challenges. What also confirms this is that Twitter’s stock rose more than 27% in the current April 4 session, which followed Musk’s announcement that he had acquired a stake of more than 9% in the social media company.

In conclusion, Twitter could not resist Elon's offer to buy a loss-making company and preferred to sell rather than make the effort to float, while Elon Musk viewed the deal as an opportunity to buy a company under financial pressure at a cheap price because he trusts his future ability to change course, add features and generate profits, and this is what he bet He personally succeeded

Iyad Aref

Founder of the Namazon website