Less than two weeks ago, Russian Energy Minister Alexander Novak said he did not rule out oil prices of $ 100, while Saudi Energy Minister Khalid al-Falih said there was no guarantee that oil prices would not rise to $ 100

These statements and a lot of comments for those who follow the movements of the oil markets resorted against the background of the entry of the US embargo on the export of Iranian oil and expectations and perhaps wishes of some, in fact these statements back to memory to May 2008 when the barrel at the cost of $ 140 then said a number of ministers such as Iranian Qassimi and English Dankan on their expectations for the arrival of oil to $ 200, actually what happened next is the exact opposite, where prices collapsed to $ 33 and then began the global economic slowdown, what is today like yesterday, and learn from the lessons of history also not all geopolitical unrest, even if arrived To the extent of the all-out war is able to raise oil prices as we remember the third Gulf War and the media war on the highs This noisy atmosphere pushed the oil to fall from 39 dollars in February 2003 to 25 dollars in May of the same difficult year experienced by the region

I think Gulf officials should expect the worst to be on the way. This is not pessimistic, but perhaps prudent and prudent for our Gulf economies to achieve their growth goals. For example, Saudi Arabia needs oil at $ 70, UAE to $ 62, Kuwait to $ 47, Qatar to $ 47, Bahrain to $ 95 and Oman to $ 76 to reach a break-even in their budgets. These prices show the challenges ahead, especially in the face of an open war of attrition in southern Arabia.

On the geopolitical side and against the background of the Iranian file lights, I think that what is happening so far can be described as a cold war that I do not think might reach the limit of confrontation (God forbid) and that may drive prices crazy, while increasing production to cover the Iranian gap is available The trade challenges between the Asian giant and the US are also locked in a cold war that could push the world into further fears of economic slowdown. Economic conditions in the European continent are also not ideal. Fears The eurozone is still at the top of the list, and the Portuguese crisis is still in place, with German growth rates falling to 1.8% instead of 1.9%, the largest economy, if we are on the fringe of fears and not optimism. Seek him in this article.

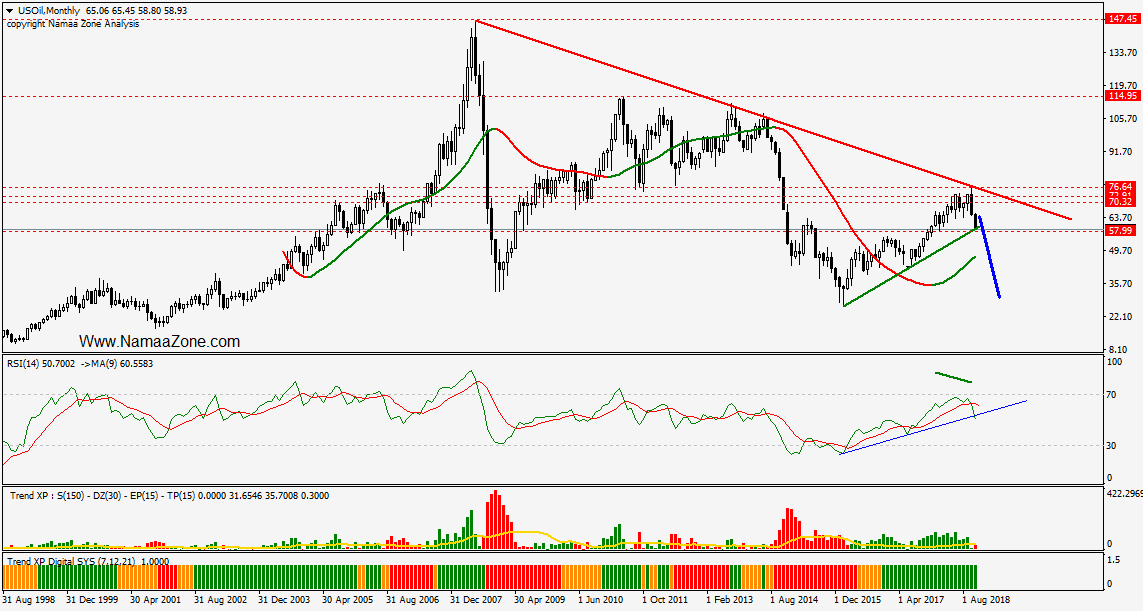

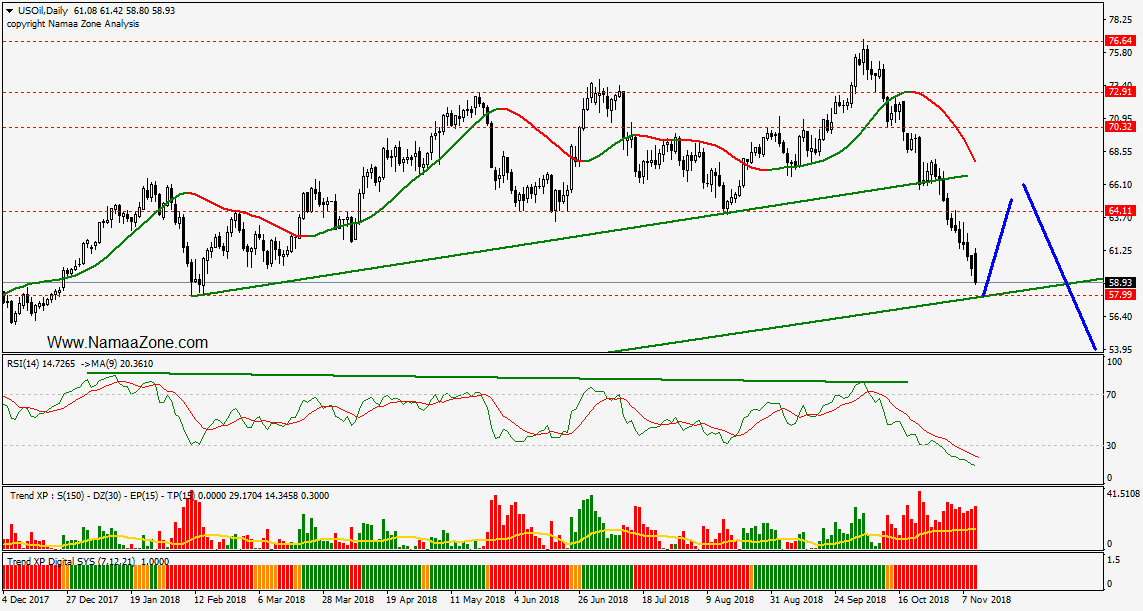

Technically, the chart says the following, with prices continuing to fall and trading today at the level of 59 dollars per barrel, the US approaching the important area at 58.10 - 57.50 which represents support from the trend line and the former support we expect to see a return to correct the downward path from the top of $ 76 up Expected to reach $ 64 or maybe $ 66, but the overall bearish trend remains the master of the situation where we expect the return in 2019 to be between $ 40-37 at the minimum, with negative divergence on the RSI & MACD indicators on the weekly basis for the recent rise from $ 66 to $ 76 , With the recent bullish movement hitting $ 76 on the visible trend line Thamtek at the top of 147 further technical negativity, and technically also can not expect to return above the level of $ 100 currently without returning above the level of $ 73 minimum

It is no secret that the expected price of a barrel of oil below the 40 dollar barrier would compound the challenges in the region, especially with the development and opening up approaches to important economies such as the Kingdom's economy. It seems that the world and circumstances may not allow it to achieve its objectives easily. The Kingdom will win and achieve what it aspires to with the promising leadership of determination and determination