Global stock markets are going through a stage full of pressures and challenges, and they need more positive factors supporting them to lift them from fears of rising interest rates and economic stagnation. Can bank profits play this role or make the situation worse, especially as they cut the ribbon of the earnings season and give the first signs of the economic picture for the sectors other.

And although high interest rates hurt the US stock market last year, it was a boon for US banks, which posted solid profits during the fourth quarter of last year, thanks to an increase in net interest income, even as banks set aside billions of dollars. In anticipation of loan defaults in light of the difficult economic environment.

Not only that, the US Federal Reserve waged war against inflation, which reached its highest levels in several decades, and raised interest rates 7 times during 2022, but also included 4 consecutive increases by 75 basis points, ranging between 4.25% and 4.50%.

The Fed's moves pushed US stocks to record their worst annual performance in 14 years over the past year, led by technology stocks that are most sensitive to rising interest rates and inflation, but the US central bank's tendency to reduce the pace of rate hikes may ease pressure on Wall Street in 2023.

US stock market movements

US stocks ended last week on the rise, with optimism about the start of the earnings season, especially after the results of the bank's operations gave positive signs that fears of economic recession did not have a significant impact on financial performance.

The three indices Dow Jones, Standard & Poor's, and Nasdaq achieved weekly gains of about 2%, 2.7%, and 4.8%, respectively, to continue the good start to the new year. Especially with the decline in inflation fears, after official data showed that the annual consumer price index in the United States slowed to 6.5% last month, compared to 7.1% in the previous November.

*Dow Jones index movements over the past 12 months

Bank profits showed that the American consumer is still resilient in the face of difficult economic challenges, which was evident in the growth of loans and increased consumer spending from credit and direct debit cards, despite inflation and high interest rates, but US banks also warned of a possible recession still on the horizon.

For example, Bank of America said consumer deposit balances show strong liquidity, with the bank's consumer customers spending a total of $4.2 trillion last year, up 10% year-over-year.

JPMorgan Bank also indicated that total credit and debit card spending for consumers and small businesses increased by 9% on an annual basis during the fourth quarter of 2022, which was also confirmed by Wells Fargo Bank that consumer spending and credit quality are stronger than pre-coronavirus levels.

This is about the economic impact shown by bank profits. As for stock performance, it achieved a strong rise with the announcement of the financial performance of major US banks, after the sector was hit hard last year due to fears of economic recession, while Goldman Sachs was the only loser.

For more clarification, we review in the following lines in detail the financial performance of the major US banks and its impact on the movement of stocks.

JPMorgan and Citigroup

Despite the economic pressures, JPMorgan, the largest US bank by assets, achieved profits and revenues that exceeded analysts' expectations during the last quarter of 2022, although in the same quarter the bank allocated $2.3 billion for credit losses or loan defaults.

And the American bank achieved profits exceeding $ 11 billion ($ 3.57 per share) during the fourth quarter of 2022, an increase of 6% compared to the same quarter of 2021, when it recorded $ 10.39 billion ($ 3.33 per share).

JP Morgan's revenues increased by 17% year on year, to reach $35.57 billion, driven by an increase in net interest income by about 48% to $20.3 billion, which reflects the difference between the interest paid by the bank on deposits and what it obtains from loans and others. of assets.

JPMorgan stock interacted positively with business results, as it rose by 2.5% in last Friday's session (January 13) to reach $143.01 per share, the highest level since late February 2022, raising its gains to more than 6.5% since the beginning of 2023.

* JPMorgan stock performance over the past 12 months

Citigroup Bank’s share rose by 1.7%, to record $49.92, raising its gains by more than 10% since the beginning of 2023, despite a decline in profits by more than 21% during the last quarter of 2022, to reach $2.5 billion.

But the decline came with the US Bank allocating $640 million in anticipation of credit loan losses, with slowing economic growth.

Bank of America and Wells Fargo

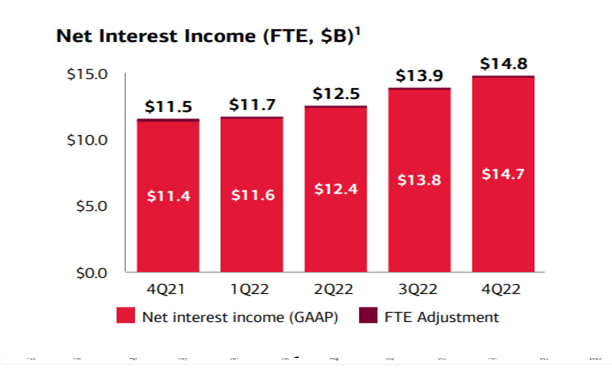

Net interest income, thanks to higher interest rates and loan growth, was a key driver for Bank of America's fourth quarter earnings and revenue, rising 29% year-over-year to $14.7 billion.

*Net interest income at Bank of America

As a result, realized net profit rose to $7.1 billion, or $0.85 per share, in the three months ending in December 2022, but the increase was only 2% year-on-year, with investment banking revenue down more than 50%, to $1.1 billion.

Revenue also increased by 11% during the last quarter of 2022, to reach $24.5 billion, although the bank made provisions of $1.1 billion for credit losses.

Bank of America shares rose by 2.2% during last Friday's session, which witnessed the announcement of the quarterly earnings, to reach $35.23, bringing its gains to more than 6% since the beginning of the year.

In the same session, Wells Fargo Bank’s share rose by 3.2%, reaching $44.22, the highest level in about a month and a half, despite a decline in net income by $2.86 billion, and a drop in revenues by 5.7% to $19.66 billion.

However, the stock was not negatively affected by the disappointing business results, as it came as a result of the bank's decision to exit the US mortgage market, which left it with $2.8 billion in operating losses after taxes associated with legal and regulatory costs.

Morgan Stanley and Goldman Sachs

Net profit at Morgan Stanley declined to $2.11 billion ($1.26 per share) during the fourth quarter of 2022, compared to $3.59 billion ($2.01 per share) in the same quarter of the previous year, and quarterly revenue fell to $12.75 billion, compared to $14.52 billion one year ago.

Nevertheless, the quarterly business results exceeded analysts' expectations, which supported Morgan Stanley's share rise by 6%, to reach an 11-month high of $97.08 per share.

By contrast, Goldman Sachs was the worst performer among the big banks, with profits down 66%, to $1.33 billion ($3.32 per share) in the fourth quarter of last year. Goldman Sachs' revenues also decreased to $10.6 billion during the fourth quarter of 2022, compared to $12.6 billion in the same period of the previous year.

In general, it can be considered that US banks performed better than expected in 2022, supported by the Federal Reserve’s decisions regarding interest, but fears of economic recession remain hanging over the business sector scene in general, which puts banks in front of influential challenges in 2023, whose features will be clear in the results of the next first quarter.

Iyad Aref

Founder of the economic site Namazon