Global technology stocks have been under severe pressure this year; As it was one of the biggest victims of the Federal Reserve’s aggressive moves to reduce high inflation rates, in light of the fact that technology stocks are more sensitive to increasing interest rates among different stock market sectors, and with the US Central Bank’s tendency to raise borrowing costs more, to what extent will the pressure continue on the sector? technology?

In his latest statements during the monetary policy conference at the Cato Institute in Washington, US Federal Reserve Chairman Jerome Powell confirmed that the bank will continue to move aggressively in increasing interest rates, until a task is accomplished in reducing inflation, which stands near its highest levels in 40 years, and this came after about a week From other comments by the Fed Chairman during the Jackson Hole symposium, which caused major turmoil in the stock markets in general and not only the technology sector, during which he made clear that a strict commitment to curbing inflation, could cause pain to families and the economy in the United States.

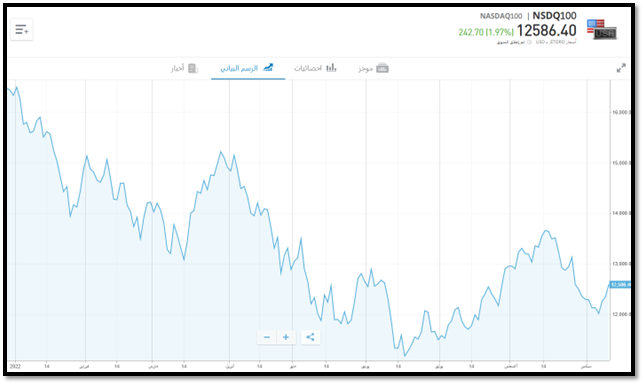

The US stock market witnessed strong losses after these statements in the session (August 26), led by the Nasdaq index, which is predominantly technological, after it fell by about 4%, recording the largest daily decline since last June, but its impact continued for several consecutive sessions, and it did not recover. Only from last Wednesday's session (September 7th).

Technology stocks struggle with Fed policy

The recent losses in technology stocks, mostly represented by the Nasdaq index, are a continuation of a downtrend that stocks have taken since the Federal Reserve began a new round of monetary tightening last March, coinciding with the escalation of the Russia-Ukraine war, which increased pressure on policy makers.

The Federal Reserve raised the interest rate 4 times this year so far, starting with an increase of 0.25%, passing by another 0.50%, in addition to two consecutive increases of about 0.75%, to reach interest rates in the range of 2.25% and 2.50%, after it was near zero in beginning of this year.

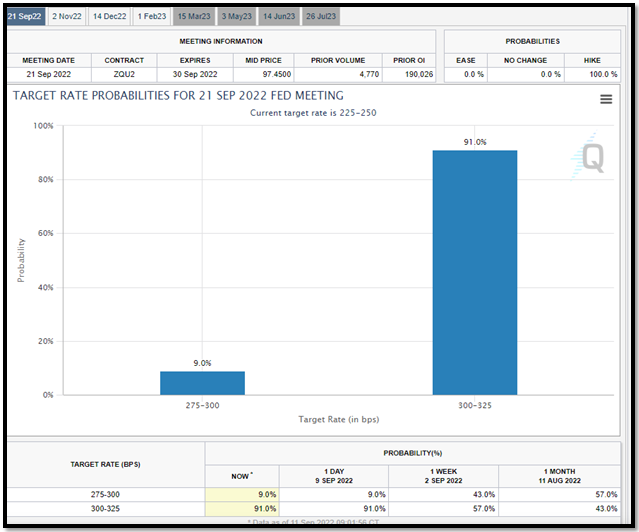

And with Jerome Powell’s recent statements, continuing the Fed’s strong moves, there is a great possibility that the central bank will raise interest rates by 0.75 percentage points this September, to be the third increase in a row at this pace, as 91% of investors expect to raise interest rates by 75 basis points. At the next meeting, the remaining (9%) see the possibility of an interest rate increase of about 50 basis points, according to the CMA tool, which tracks US interest futures trading, as the following chart shows.

Technology stocks were also hit, with US 10-year Treasury yields rising above 3.3%, near a 15-year high, as higher bond yields raise concerns about valuations of technology stocks in particular, as they often rely on borrowing for significant growth.

The economic background remains very difficult for the technology sector and growth stocks in general, with fears of recession in light of high inflation and interest rates, and amid these pressures, how has technology stocks performed since the beginning of this year?

Technology stock performance

Higher interest rates mean that future profits for big tech companies will not be as much as they were when interest rates were lower, and higher interest makes financing more expensive, especially for smaller companies compared to companies like Apple and Microsoft, which have a lot of cash.

Amid these pressures, technology companies have suffered a difficult year, as the Nasdaq index has lost more than 23% of its value since the beginning of 2022, to be above the level of 12,000 points, which means that the technology index is currently in the bear market area, and the technology sector shares in the Standard Index have fallen. & Poor's by more than 21%, and this coincided with strong, albeit less severe, losses for the Dow Jones Index and Standard & Poor's by about 12% and 15%, respectively.

* The performance of the Nasdaq index since the beginning of 2022

The Nasdaq index took a declining path that accelerated after the Russian invasion of Ukraine and its repercussions on price movements, until last June, it recorded its lowest level since the shock of the Corona epidemic in 2020, at levels of 10 thousand points, but then recovered until it exceeded the level of 13 thousand points in mid-August, before it reached 10 thousand points. It has been falling again since then.

The Nasdaq index recorded the longest daily decline since 2016, after it fell for about 7 consecutive sessions that ended on Tuesday (September 6), before recovering in the last three sessions, to be able to achieve weekly gains of about 4%, for the first time after losses that lasted for about 3 weeks. Consecutive.

The most valuable technology companies in the stock market were among the biggest losers this year, as Apple's stock fell by more than 11% in 2022, bringing the market value to $2.5 trillion, after the company aspired to shine above the $3 trillion level.

Microsoft's share also fell by more than 21%, bringing the market value to less than two trillion dollars, and Amazon and Alphabet shares fell by 20% and 24%, respectively, while the Meta (Facebook) share was the biggest loser, as it fell by 50% since the beginning of this year.

There is no doubt that high inflation, rising interest rates and fears of economic recession are strong negative factors affecting tech stocks and growth, so is the economy showing signs of recovering quickly before sinking into recession supporting stocks, or will the suffering continue and the Fed's war against inflation continue?