Experts and analysts expect that the Saudi real estate sector will witness a rapid recovery from the effects of Corona, thanks to government support and high demand, and the facilitation of real estate financing.

Analysts believe that the mega projects that the Kingdom is working on, such as the Red Sea and Qadiyah project, and the city of Neum, make the Saudi real estate development sector one of the promising sectors during the coming period. < / p>

Real estate management and development companies listed on the Saudi Stock Exchange were exposed to strong pressure during the first quarter of 2020, especially the last month of it, as a result of the interruption of economic activities due to the precautionary measures to reduce Corona .

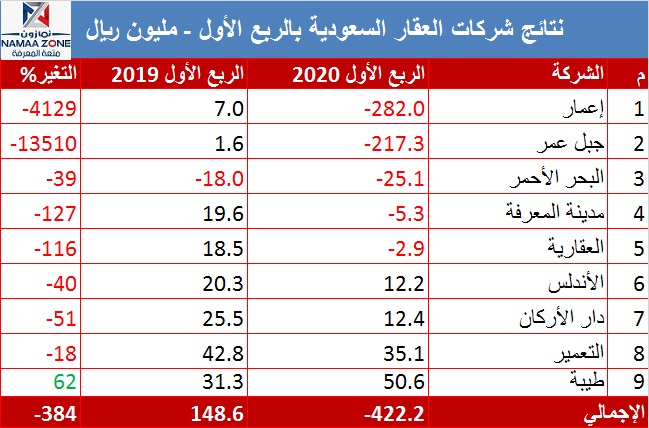

According to the data available at (Namazon), a large number of Saudi real estate companies incurred net losses in the first quarter of this year, as a result of lower revenues and increased expenses. < / p> The results of 9 companies listed in the sector, whose fiscal year ends at the end of December of each year, revealed a net loss of about 422 million riyals, for the first quarter of 2020, compared to a net profit of 148.6 million Real, for the same period in 2019.

Emaar captures half of the losses.

<5 style = "direction: rtl; text-align: right;"> 5 companies incurred net losses in the first quarter of this year, with a total loss of 532.5 million riyals, compared to 28.7 million riyals net profit for these companies, in the first quarter of the previous year . Emaar exports the existing economic city, after the company turned to losses, in the first quarter of 2020, with a net loss of 282 million riyals, representing about 53% of the total losses.The company explained that the reasons for its conversion are losses in sales, and a slowdown in economic activities in general in the Saudi real estate sector due to the repercussions of the Corona pandemic.

Jabal Omar Development recorded the second highest losses, at the level of the Saudi real estate sector, with a net loss of about 217 million riyals, compared to 1.62 million riyals net profit for the same period last year .The company indicated that the reason for achieving the net loss during the first quarter of this year, compared to the net profit in the same quarter of the previous year, is due to the decrease in other income.

>The company explained that the increase in net loss is mainly due to the increase in general and administrative expenses and a decrease in gross profit compared to the same quarter of the previous year.