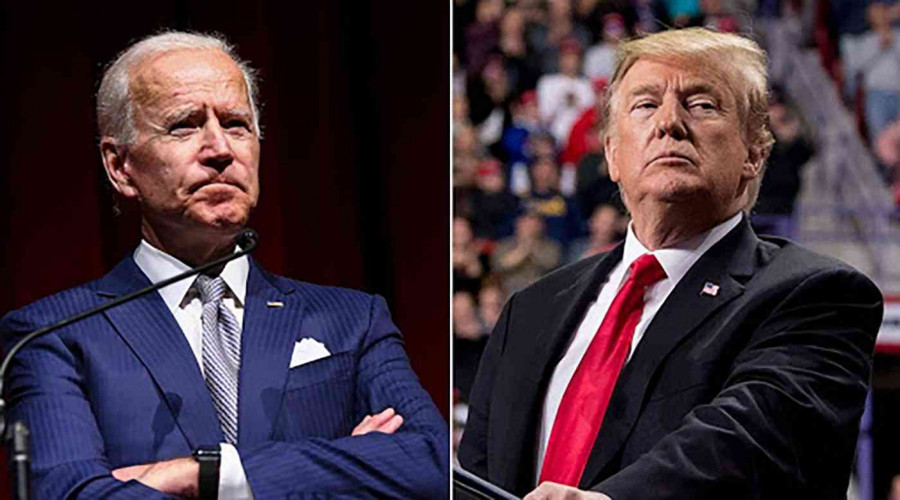

Historians will pause a lot in 2020 because it will witness an unprecedented epidemic and one of the fiercest US elections In recent history, the first presidential debate may reflect its features between President Donald Trump, the Republican candidate, and Joe Biden, the Democratic candidate. The largest evidence for this is that the verbal bickering between the two candidates was the title of the decline in the level of discourse below the level of the presidency.

tensions are so high and the potential results marred by dark clouds, that many investors do not know what to rely on He has to do with buying and selling decisions, even despite broad expectations of Biden winning, as the average opinion polls on NBC News indicate that Biden currently has the support of 51.7% of registered voters compared to 41.2% for President Trump.

>

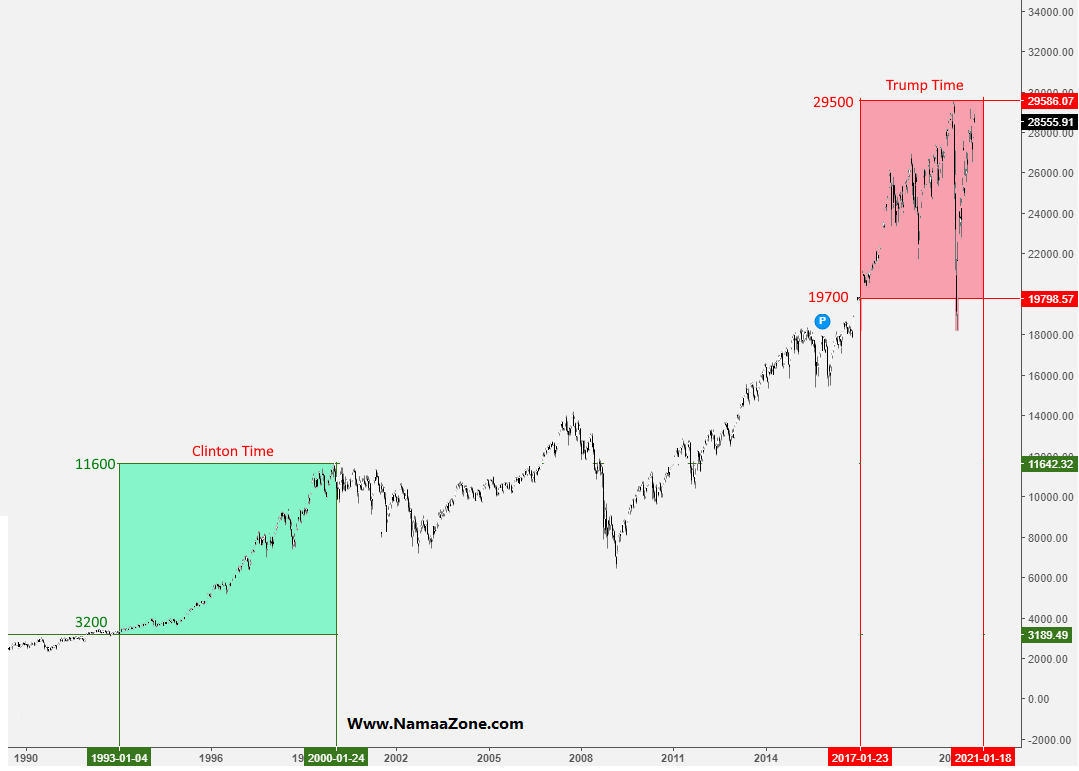

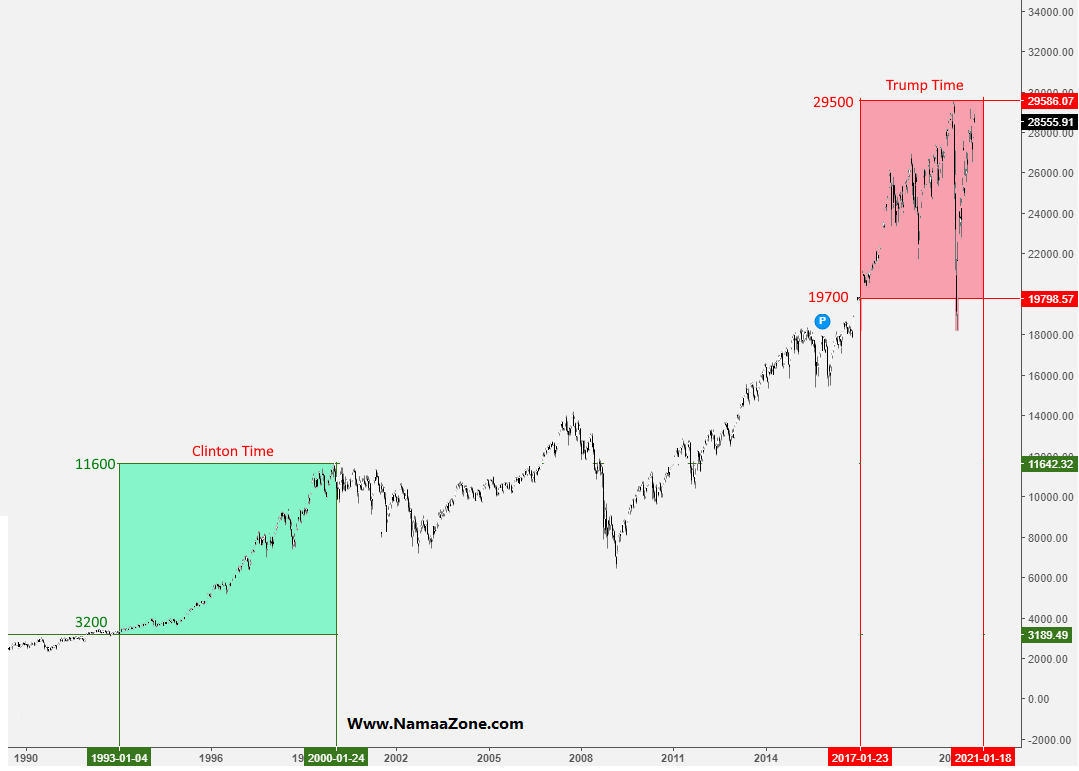

In fact, opinion polls indicate an increased likelihood of a democratic sweeping that could pave the way to economic prosperity early The year 2021 brings to mind the era of President Clinton, in which the markets achieved an increase of more than 350%, and such development would enhance the growth expectations and the profitability of companies, but the markets remain wary about the candidates' handling of the Corona crisis as well as the negative impact of the potential tax increase by Biden Contrary to Trump's trend towards more tax cuts, in addition to the fact that his term witnessed many sharp fluctuations in the markets, reflecting the nature of his trade wars and his populist tendencies, which ultimately reflected on the rise of the markets of less than 60%, contrary to what President Trump claims that his era was the best for the financial markets !! < / span>

Of course, any of the candidate's policies will have positive or negative impacts on global markets, and because The upcoming elections do not only concern the people and the American economy, and the results of the November 3 vote will have a significant impact globally. It was important to monitor expectations for global stock markets and all asset classes as follows: -

stock markets

There is a traditional view that Trump's victory would be beneficial to risky assets unlike Biden. Correct for the reaction at first, based on the rise in the US stock market by more than 50% since Trump's victory in the 2016 election.

But the results of the Senate and the House of Representatives are considered crucial as it is the legislative body that may pass or prevent financial incentives .. .