Oil prices have received a severe blow in recent weeks that made them erase all the gains they gained as a result of the Russian invasion of Ukraine, due to fears of economic stagnation dominating the minds of investors at the present time, amid the strict monetary tightening policy taken by the US Federal Reserve and other central banks around the world, motivated by curbing inflation .

These recession fears led oil prices to their lowest levels before the outbreak of the Russian-Ukrainian war, as Brent crude fell below $90 a barrel, while the US NYMEX crude tumbled below $80, recording its lowest level since last January, after a series of declines that continued for four consecutive weeks.

This coincided with strong losses in global stock markets and the US Dow Jones index fell to its lowest level for this year under 30 thousand points, in contrast, government treasury bond yields increased and the dollar continued its strong rise to its highest levels in 20 years, which increases pressure on oil prices, and we will discuss in the lines The following is the full story of crude's decline in recent weeks and what about its future prospects?

Economic recession fears

The fears of oil investors stem from the global recession, whose features have appeared in all sectors of the economy, that it will consequently lead to a decline in demand for crude. And households, in the sense that he is not afraid of a recession as much as he is concerned about the continued acceleration of inflation, which reached its highest level in 40 years at 8.3% last August

Even more than that, the American policies over the past months have all been inciting and supporting the reduction of oil prices by direct entry into the market through the sale of strategic stocks. It is not hidden from anyone that the great correlation and the impact of high oil prices on the rise in inflation, the oil barrel represents the backbone of economic life on this planet and enters In the manufacture of most goods and services

In this sense, in fighting inflation by all means, the US Central Bank has raised interest rates 5 times in a row since last March, not only that, but the last 3 interest rate increases were by about 75 basis points, which is the largest pace in about 30 years, and was preceded by raising interest rates by about 0.25% and 0.50%, respectively.

After the latest increase last week, US interest rates ranged between 3% and 3.25%, with Fed members expected to reach 4.4% by the end of this year and rise to 4.6% next year, exceeding previous estimates.

In addition to recession fears, the increase in interest rates is strengthening the US dollar, making it more expensive to buy oil, which is priced in the US currency, for investors who own other currencies, as the dollar index against 6 major currencies exceeded the level of 113 points, for the first time in more than 20 years. general.

This caused the euro to fall to its lowest level since 1999, and sterling to its lowest level in 37 years, to bring here a more than 50-year-old saying by US Treasury Secretary John Connally to foreign finance ministers in 1971, the dollar is our currency but it's your problem.

Despite fears of a slowdown in global oil demand due to interest rate hikes, major energy institutions such as the International Energy Agency and OPEC are still taking a wait-and-see approach in their forecasts for global oil consumption next year, although it may change in the coming months, with raising operations. Recent interest and growing recession fears.

In its latest monthly forecast, OPEC sees global oil demand growing by about 2.70 million barrels per day next year, reaching the same estimates put forward by the organization in its first forecast for demand for 2023 last July, compared to 3.10 million barrels per day expected for the current year.

While the International Energy Agency expects global oil consumption to grow by 2.10 million barrels per day, bringing the total to 101.8 million barrels per day, but at the same time it reduced its estimates for the current year by 110 thousand barrels per day, so that demand is expected to grow by about two million barrels per day.

What about oil supplies?

Fears of supply shortages may be the only support for the possibility of oil prices rising again, especially after Russian President Vladimir Putin announced a partial military general mobilization last week, exacerbating political tensions in Eastern Europe.

So far, Russian oil exports are still largely resilient in the face of the torrent of Arab sanctions, with Russian crude heading to other markets such as China and India, but the real flexibility will appear if Moscow is able to sell its oil after the entry into force of the European embargo at the end of this year.

The International Energy Agency estimates that Russian oil production will decline by 1.9 million barrels per day by next February, coinciding with the entry into force of the European Union's ban on Moscow's exports of crude and oil products, compared to 11 million barrels per day last August.

As for US oil production, which many were counting on to boost global supplies and reduce domestic fuel prices, which trouble consumers, it showed a very cautious response to the supply shortage crisis, and did not rise as expected so far, as companies focused on strengthening their balance sheets and achieving capital discipline, Instead of increasing digging activities.

Now, the US Energy Information Administration expects US oil production to reach 11.8 million barrels per day by the end of 2022, while it estimated at the beginning of the year that it would exceed 12 million barrels per day, compared to about 11.3 million last year.

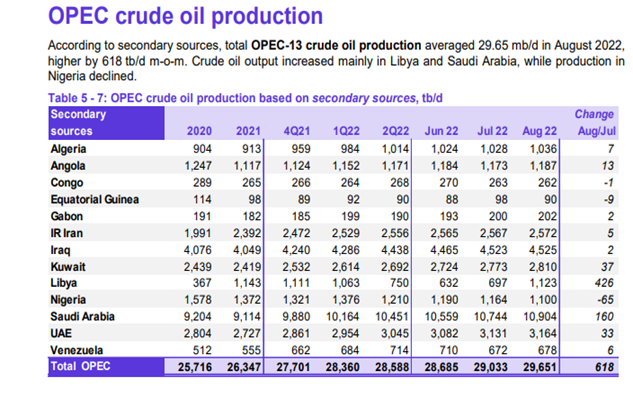

With regard to the production of the Organization of the Petroleum Exporting Countries, the actual controller of global oil markets, it continues to rise in the past months, reaching 29.651 million barrels per day at the end of last August, compared to the 2021 average of 26.347 million, supported by the increase in Saudi oil production, which compensated for supply disruptions in Nigeria. Libya and others, as shown in the following table, which includes the latest OPEC estimates.

But in fact, the increase in OPEC oil supply is still insufficient to offset the fears of Russian oil shortage, as it is estimated that the production of the OPEC + alliance is 3.6 million barrels per day less than the target, especially with the somewhat cautious policy taken by the OPEC + alliance recently, After the coalition, at the end of August, compensated for the record cuts it had approved during the epidemic, it decided to increase production by 100,000 barrels per day in September, then returned and approved a supply cut by the same amount during next October.

* Wide performance No oil since the beginning of 2022

No oil since the beginning of 2022

The strong losses were due to the Federal Reserve’s decision last week, which pushed oil prices to record its fourth weekly loss, and reduced its gains since the beginning of the year to only 5% for US crude and 15% for benchmark Brent crude, after it reached 50% for each of them in the wake of the Russian invasion of Ukraine.

The US Energy Information Administration believes that the price of Brent crude may reach $ 98 a barrel in the fourth quarter of 2022, before recording $ 97 on average in 2023, but it indicated that estimates are subject to a great state of uncertainty about the economic stagnation and the resilience of Russian oil exports to Western sanctions.

Although the economic stagnation may lead oil prices to a strong decline if it occurs next year, some believe that the switch from gas to oil this winter, in light of the lack of Russian supplies, may support demand for oil even in a recession environment, but expectations of a decline in crude supplies Russia, with the European embargo and the possibility of imposing a ceiling on Russian oil prices, remains a major supporter of the return of oil prices above $ 100 per barrel levels.

Oil price movements and technical expectations for the next track

In light of all of the above from the fundamental analysis of the price movement, technical analysis tells us more than that, as oil prices have taken a downward path since it crossed $120 a barrel in early June to reach today the level of $78. We note technically a departure from the general ascending channel from the bottom of April 2020 when prices crashed to near 10 dollars in light of the Saudi-Russian disputes and fears of the Corona pandemic at that time, with the formation of a clearly defined technical summit in March 2022 to end the rise with a five-way impulse wave from the bottom of April 2020, and now begins the correction phase, which we believe will continue to reach prices A barrel of US oil WTI to the target buying range between 65 - 55 dollars a barrel over the next few months

In the end, prices fall between the hammer of the specter of recession and the anvil of fears of lack of supplies, and between this and that, the American and global economy will remain among the biggest winners from keeping prices below the $85 barrier in their global war on inflation, and if the US policies actually succeed in pushing oil prices down and bringing them to the range The aforementioned target, as the chart tells us, could actually help lower oil prices to rein in recession fears.

Therefore, the most important conclusion that can be reached, is that the current drop in oil prices will be a key factor to calm the Fed’s policies in raising interest rates at least during the current year 2022, and thus calm the concerns and fears of investors and weaken the current bearish momentum of the markets and give the opportunity for more rationality, and this is the result, gentlemen in My opinion may put us directly in front of the expectation of a beautiful recovery rally that extends until the beginning of 2023 in the global stock markets, especially in cryptocurrencies, to become the biggest winner

Best wishes to all of you

Eyad Arif

Founder of the economic site Namazone