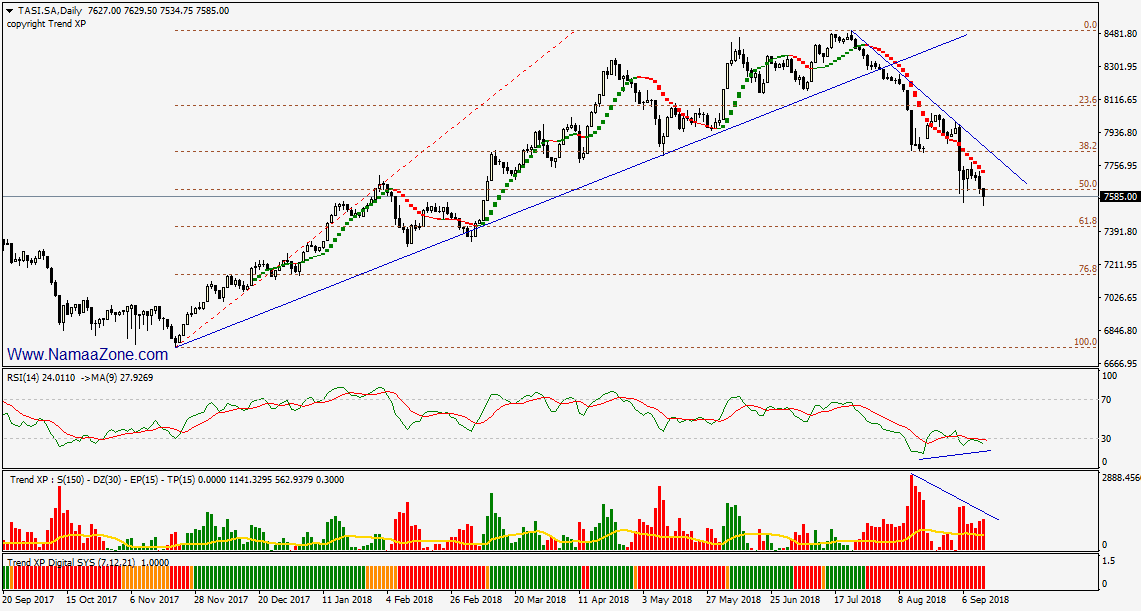

The Saudi market closed last week at 7590 points, down more than 10.70% from its peak of 8,500 points on July 23 through quick and sustained profit taking for more than 7 weeks without noting any technical rebound to ease the bearish momentum of the market

In December of last year, through the road map of Tassi, we thought that the decline during that period below 7,000 points was a negative side at that time and we preached that the market will return to reach the level of 8500 points and before reaching this level we called back Warning signs that the market has reached levels to be cautious and take profits were the following tweets

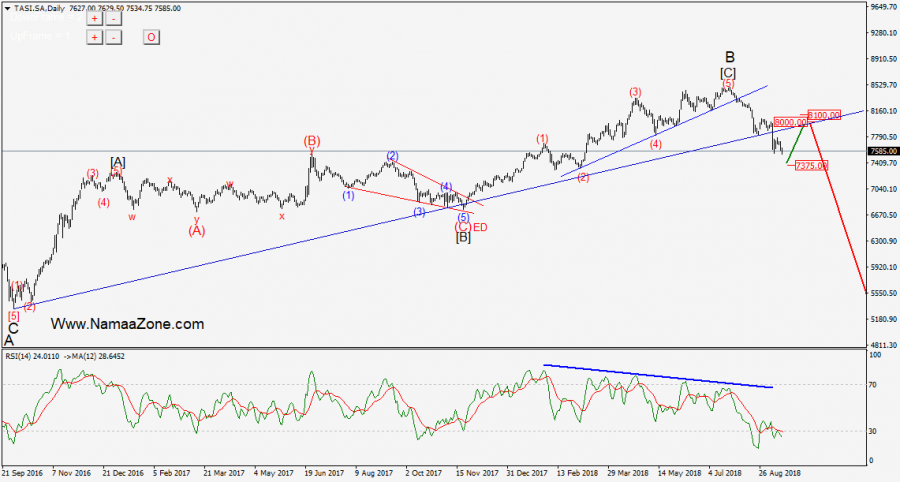

Where we pointed to the expectation of a deep correction to return us below the level of 6700 points in the coming months, and push us to the technical reasons, the most important nature of the wave structure of the process of the rise from the bottom of October 3, 2016 from the level of 5300 points as the upward movement of three correct correction is clear, The last of the bottom of 6752 points on 21 November 2017 has been accompanied by technical signals indicate the discharge of the existence of negative exits and also a decline in volumes

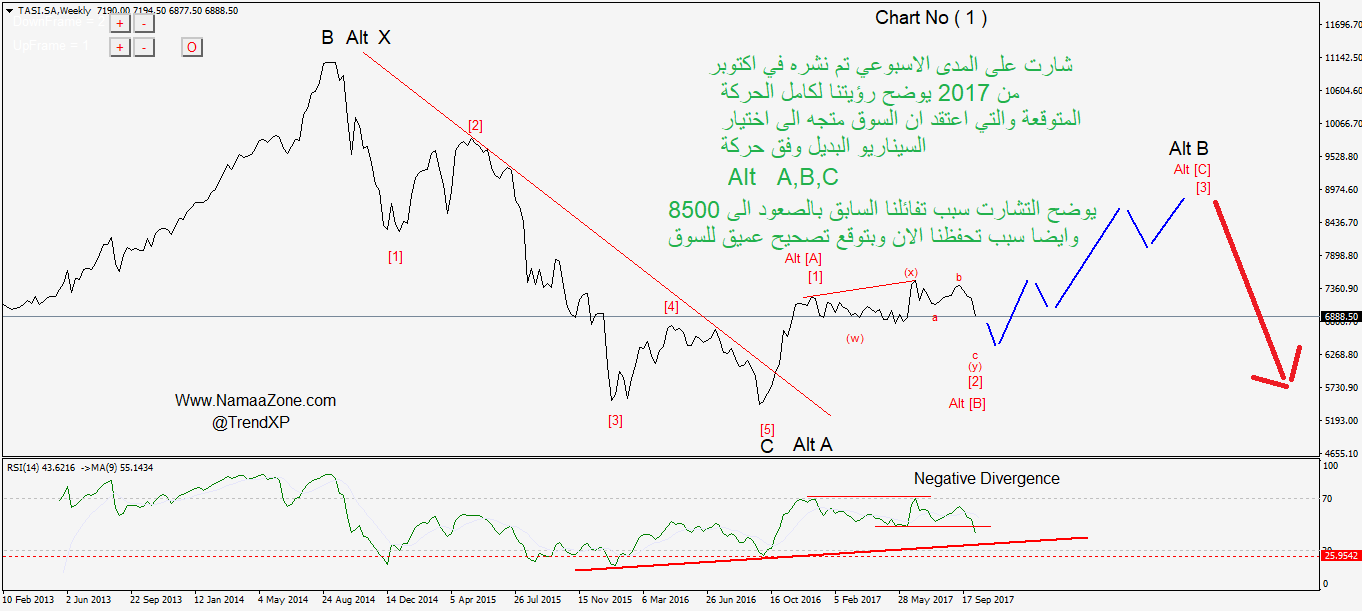

You can refer to the article below which was published in previous issues in October with a comment for a clearer picture

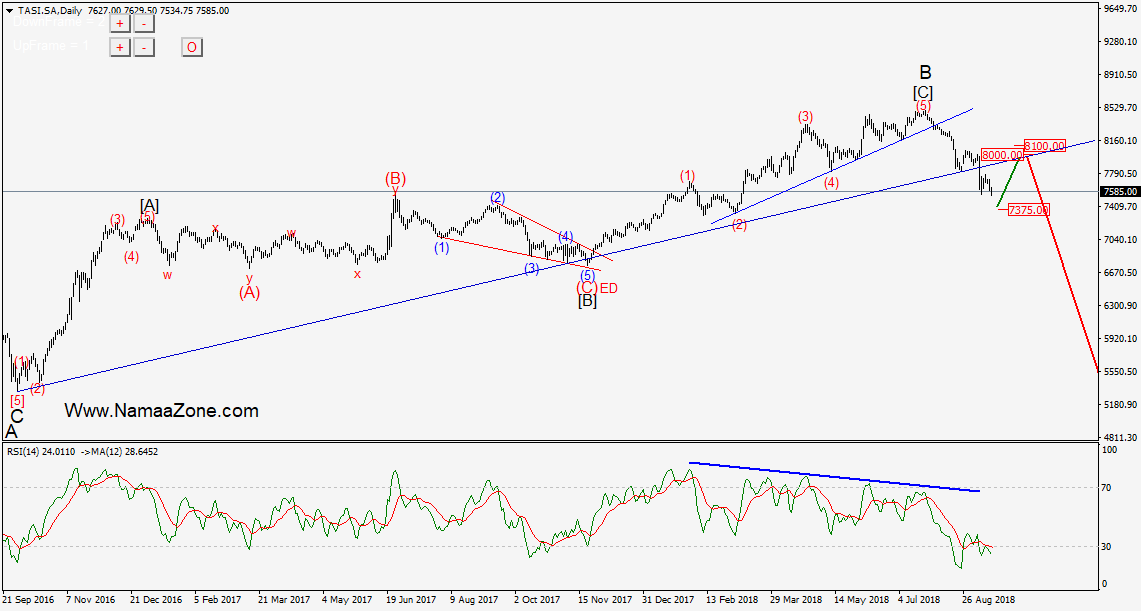

Technically we believe that the Saudi market has formed a peak at the level of 8500 points out of the main ascending and sub-course has begun a deep correction in the market will be dominated by the sellers for months to come up to levels of 5200 points, I know that these figures may seem frightening and ask God to be We are wrong in our technical outlook but so far the downside momentum seems to be clear and we believe that at the very minimum it will go below the 6700 level and we may see a breakout at 6300 points and then we repeat our recommendations with caution and after the rush to buy in the current phase

The following chart shows the construction and waveform numbering

In the short term for meetings next week is expected to continue the decline to reach the level of 7375 points and we expect to see a price pivot and then correct the downward movement of the recent decline may continue for the coming weeks, especially with anticipation of the results of the third quarter to return to the levels between 8000 - 8100 points and then continue and complete landing South towards the goals that have been mentioned

On the other hand, to complete the technical analytical image, even if our own vision is violated, any return to the market in the coming months to trade above 8300 points will lead us to rethink our calculations and may delay or negate the current bearish scenario because it means expecting a new high of 8,500 points and the upside move From the bottom of October 3, 2016 from the level of 5300 from the rise of a correction to a triangular wave of a five-nation upward and this may give a sense of the formation of a historical bottom of the market at the level of 5300 points and accordingly looking at any declines then it will be within the natural corrections, and this scenario is found in the attached weekly weekly

Looking at the results of more than 170 companies during the first half of 2018, 100 companies reported a decline in profits, as well as 45 companies recorded losses of these figures may be indicative that the results of the third quarter may not be better than the last two quarters and given the situation of the average repeat earnings For the market in general, we find that it stands at the level of almost 16, there are many companies exceed the profits of the level of 20 times and I think that the expected landing process will directly affect the total of these companies to be the biggest loser, so we recommend the mitigation and exit from the companies plywood and inflated prices may see a decline in price Exceeds 40%

I would like to emphasize that what happens in the market from ups and downs is always linked to market cycles and may not necessarily reflect the strength and strength of Saudi Arabia's economy and its regional and international leadership, and these courses usually create good opportunities for restructuring troubled companies and re-sorting the wheat from the fat. Is a positive thing on the general path of the market, but directly affects the small investors and suffer losses of the Yemeni and this is important for us to spread technical awareness for them, as the big speculators and investors are aware of their affairs.

Good Luck