After strong losses since early this year, the shares of the giant electric car company, Tesla, returned to shine again, amid significant increases as it is known in recent years, after announcing its plans to split the shares, for the second time in nearly two years, so that it can pay dividends on shareholders.

Tesla thus joins the recent wave of stock split decisions in major companies, as Google and Amazon announced this year a stock split, and Apple preceded them nearly two years ago in an attempt by major technology companies to make the stock accessible to investors, following massive gains in recent years.

On Monday, Tesla announced in a statement to the US Securities and Exchange Commission that the board of directors approved the stock split, but that it will hold a shareholder vote at its annual meeting, in June, on the proposal, to approve the actual split or limit the increase in the number of authorized shares. of common stock. Where Tesla wants to do this in order to pay dividends to shareholders, this time dividends will be paid to shareholders in the form of additional shares instead of cash, although this does not affect the value of the company, but it reduces its share price, which may later affect the price of The stock limits its rise due to pressures to take profits from investment returns

The last time Tesla took this step was in 2020, which witnessed gains of more than 700%, as the company was forced to split the shares, amid the huge rises, to make the stock accessible to small investors. 1, the stock rose by more than 80% over the next three weeks until the split officially took effect on August 31, 2020, and since the last split - when the share price was near $ 500 - the stock has jumped by more than 150% so far.

This heralds great gains awaiting Tesla after approving the current stock split process, especially since in the session announcing this decision (March 28), Tesla stock jumped more than 8%, to reach $ 1091.81, the highest level since last January 12, which added about 84 The market value of the electric car maker increased in one day to a billion dollars, and its rally was boosted by more than 40% from this month's low of $766.

Before these gains, Tesla's stock came under great pressure this year, after statements by CEO Elon Musk, that the company will not offer any new models to customers in 2022, but rather that the human robot business will become more important than the electric car industry over time, This raised investor fears.

With the recent gains, especially since mid-March, Tesla's stock turned into the green range for this year with gains of 4%, compared to losses of nearly 4% for the Standard & Poor's and Dow Jones indices, amid the pressures of the Russian-Ukrainian war, bringing the market value of Tesla back above the trillion dollar mark. , at $1.14 trillion, to become the fifth largest US company by market capitalization, behind Apple, Microsoft, Google and Amazon.

* Tesla stock performance since the beginning of 2021

In addition to the stock split process, there are expectations of further rise for the stock in the coming period, especially with optimism regarding the car delivery numbers and business results for the first quarter of 2022; It is expected that the rate of delivery of Tesla cars in the first three months, to range between 310 and 320,000 cars.

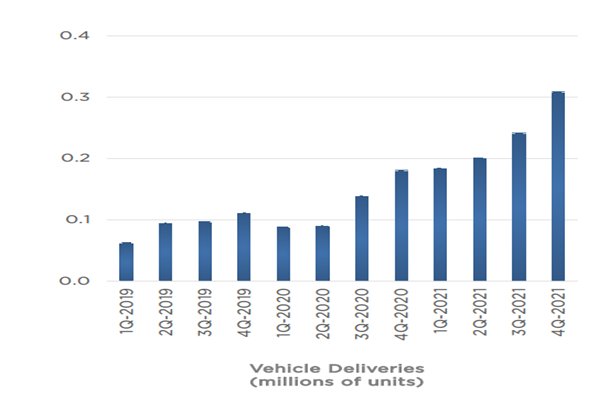

In the last quarter of 2021, the rate of delivery of Tesla cars increased by about 70%, to a record level of 308,600 thousand cars, and although expectations for the first quarter indicate a small increase, but it is enough to maintain momentum, especially in light of the return of the closure in China, and the trend of Tesla The suspension of production at the Shanghai plant, as well as the Lunar New Year holiday in China often affects the first quarter numbers.

*The rate of delivery of Tesla cars in 2020 and 2021

Tesla stock also received support, with the company finally beginning to deliver its first cars (Model Y) from its new factory in Germany, after many obstacles the American company has faced since announcing its plans to build a car and battery factory, which JP Morgan expects will produce 54,000 cars in 2022. That will rise to 280,000 cars next year.

As for the technical movement, the current bullish momentum indicates an anticipation of a rise above the historical peak of 1245 dollars, targeting 1264 dollars, which may represent important resistance levels in the stock’s path that may push it back to test the psychological support level of the thousand dollars

On the other hand, we cannot ignore that the recent rise of Tesla stock coincided with the rise of Bitcoin by more than 12% in the past 7 days, to exceed the levels of $ 48,000, which enhances the value of the electric car company’s possession of the cryptocurrency, especially as it bought a total of 1.5 $1 billion worth of bitcoin last year.

Iyad Aref

Founder of the Namazon website