Trend lines or trends are one of the most common and widely used technical analysis methods.

And I'll try to explain it in a simple and easy way to make the most of it.

Trend lines are support and resistance levels, but they are not stable, so when the price takes a direction, these lines give good entry opportunities as the price changes up or down.

The trend line is negotiable after touching the left hand for the third time so that it is confirmed as a moving support

Now we take examples so that we can understand more.

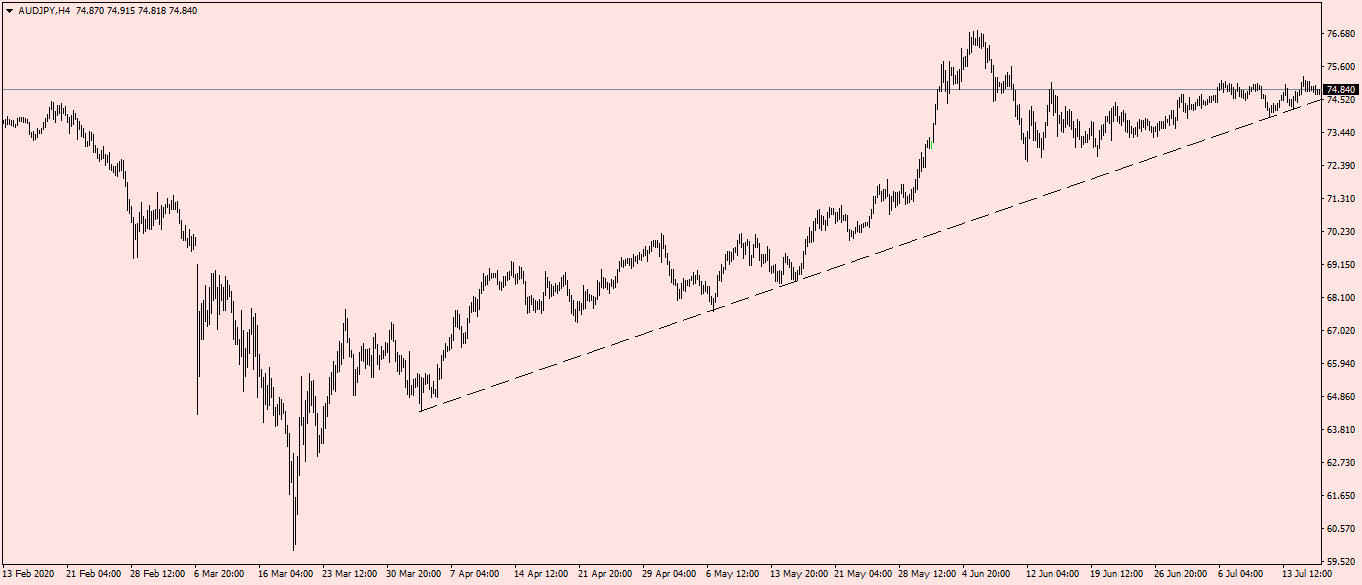

Example 1

A pair of Australian Yen on the four-hour frame and a bullish trend line and every time the price touches the trend line it is a good opportunity to enter into long positions

The stop loss is below the trend line and profit taking is at the nearest peak or price resistance

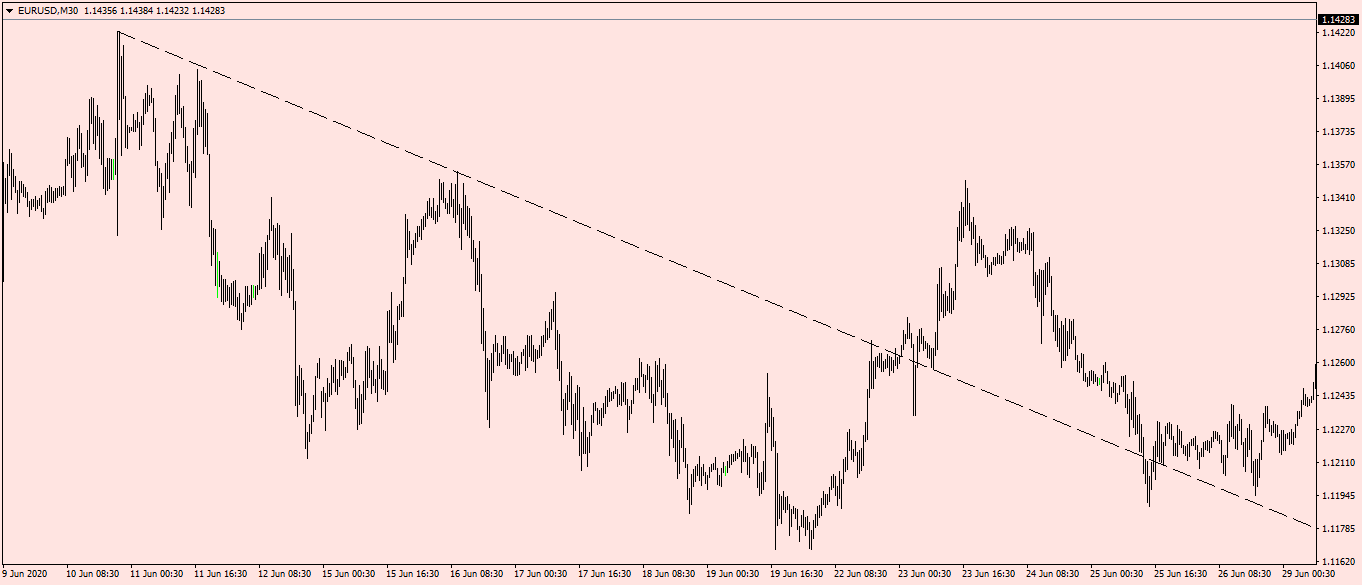

Example 2  EURUSD, the half-hour frame, a falling trend line, and every time the price touches the line, it heads down

EURUSD, the half-hour frame, a falling trend line, and every time the price touches the line, it heads down

Sell and stop loss deals will be above the trend and take profit at the nearest bottom or support

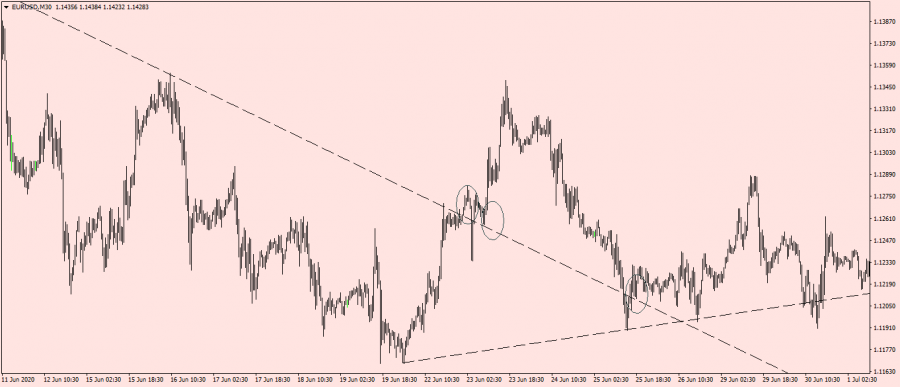

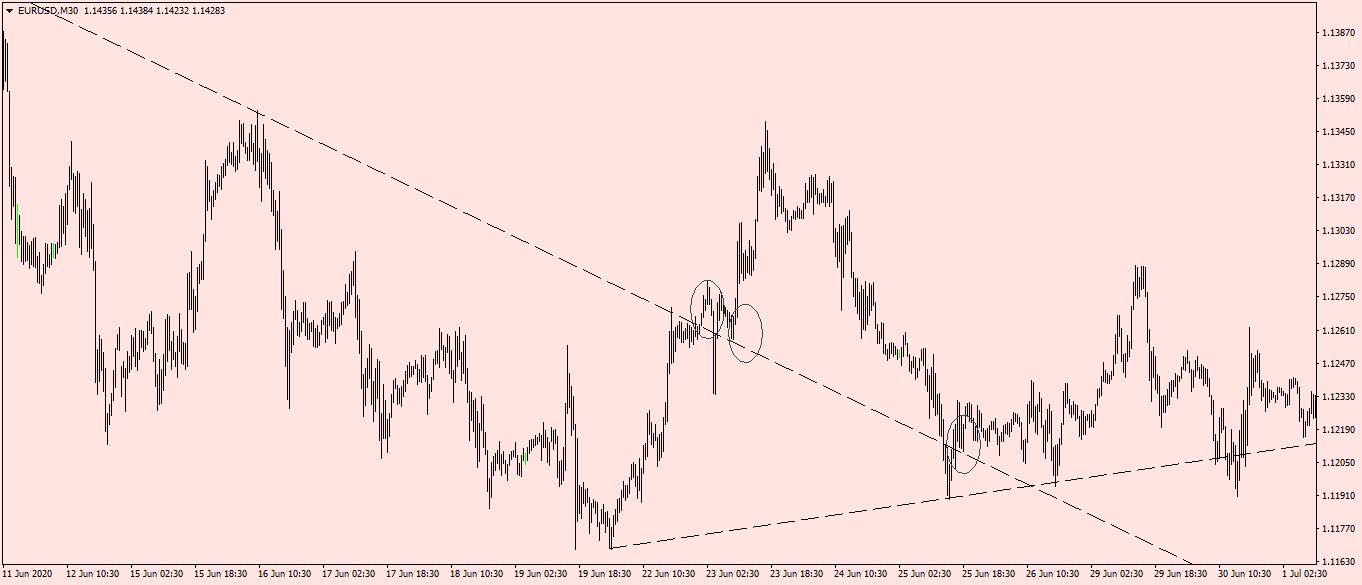

Example 3

Continuing with the previous example, we take the idea of breaking the trend as a useful way to know the trend change.

Continuing with the previous example, we take the idea of breaking the trend as a useful way to know the trend change.

When the trend is breached, it will change from a bullish to a bearish, and vice versa

When the price here broke the trend line up, the trend changed and became an opportunity to enter long positions

Either from direct fracture or from re-testing, as we see on the shown circuits.

We also see the formation of another bullish trend line after the breached downward movement to confirm the change of trend

UAE's Mubadala leads a $400 million financing round for German insurance company Wefox

Wefox, an insurance technology company founded by former emp.. Read more

Saudi Arabian Centers distributes dividends to shareholders for the second half of 2022 with a total of 356.25 million riyals

Arabian Centers Company has approved the distribution of cas.. Read more

The largest sovereign funds: "Abu Dhabi Investment Authority" advances to third place globally, with assets of $708.8 billion

The Abu Dhabi Investment Authority has advanced to the third.. Read more

Accumulated losses place Emirati companies on the "second category" screen, pending anonymity

Special Report - (Namazone): A group of companies listed.. Read more

Details 142 Saudi initiative to face the consequences of "Corona" B214 billion riyals

Special Report (Nmazzon): The government announced that.. Read more

Will gold remain a safe haven asset?

Gold has long been a source of controversy and contention am.. Read more

Global trade is expected to decline in the coming months

The economics department of Qatar National Bank (QNB) said t.. Read more

Analysis .. How will major central banks respond to the increasing cases of financial instability?

The global macroeconomic environment is experiencing some of.. Read more

The euro is below the dollar .. the lowest level in 20 years

For the first time in 20 years, the euro fell below $1 on Tu.. Read more

"OPEC"...The pressures of supply shortage will continue next year

OPEC expected global demand for oil to increase next year, b.. Read more

How to take advantage of trend lines

NamaaZone " The Power of Knowledge"

Analysis Service |

Its a free service for technical consultation provided by NamaaZone to the website visitors. |

Open account Request |

NamaaZone provides a range of integrated trading solutions in local and global financial markets |