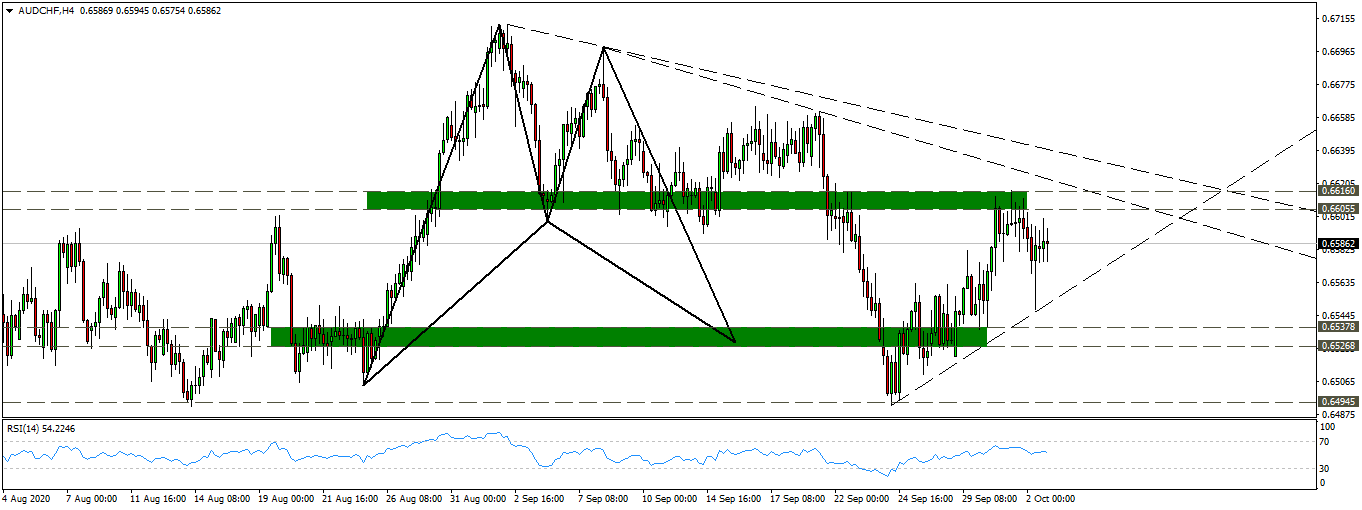

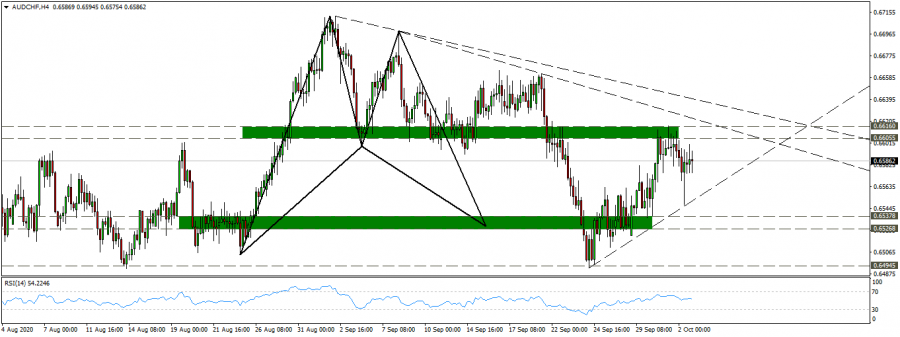

Pivot point: 0.6600

Preferred scenario: Short positions below the 0.6600 level, targeting levels 0.6540-0.6525

Alternative scenario: Long positions above the 0.6600 level, with targeting levels of 0.6660

Comment: We previously indicated the Australian franc pair expected to rise through this Analysis

Whereas, the pair was moving on the four-hour timeframe in a downward direction from the top of last August, where it fell from 0.6710 levels, dropping more than 200 points at the time

Then the price rose from the support level 0.6495, which was previously based on it in mid-August with oversold saturation on the RSI momentum indicator

The price formed a bat harmonic pattern with 88% Fibonacci retracement of the xa leg at levels of 0.6525-0.6435, so that the price actually rose to achieve its targets at levels of 0.6605-0.6615

The price met the resistance area 0.6605-0.6615, and it is expected to drop from it with the break of the rising trend line from September's low to reach levels of 0.6540-0.6525