The Dubai Financial Market ended the month of November with a decline of 5.93% to 3420 points. The month of November marked the completion of the disclosure season for the listed companies' results for the nine months ended 2017. The results of the companies in general were good. 63 companies reported their results and achieved them. 51 profit companies, while 12 companies lost losses. It is worth noting that only 30 companies witnessed an increase in their profits for the same period in 2106 while 32 companies witnessed a decline in the profit rate for the same period and this led to putting more selling pressure on The market as the geopolitical situation in the region lifted and cautious Investors have added to risk appetite. November also saw the addition of a new share, Emaar Development, and the markets are preparing for the new subscription to ADNOC, which we expect to be more popular than Emaar's development.

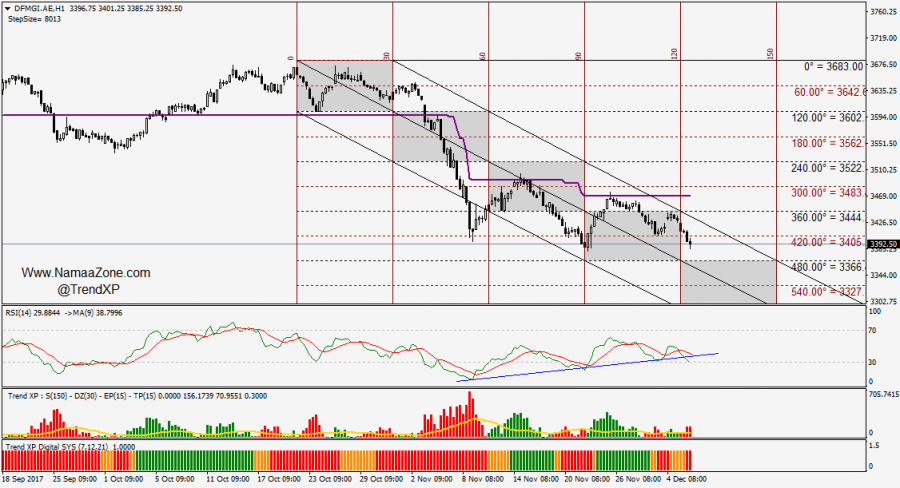

Dubai Financial Market Technical Road Map for December

On Tuesday, the index closed at 3393 points and Emaar closed at 7.62 dirhams

General Technical Vision

We have seen a bearish trend since the peak of 3684 points and in the latest report we expect the market to witness further pressures to reach 3366 and 3330 points where we believe that this region represents a support and buy for the market and in the December roadmap stand at the same vision and figures and watch the market return And therefore we believe that the market is able to continue to rise and achieve a summit above the level of 3730