Dubai Financial Market (DFM) opened its trading session in March 2018 at 3209 points, where last month witnessed a decline of 4.43%, marking the biggest decline since last November. In our report for February, the results of companies for 2017 were disappointing or minimal. Of the 56 companies reported declines or losses while 67 companies reported profits. These weak results appear to have affected investors' decisions as well as pressure to buy in order to participate in IPOs.

It is clear that Dubai Financial Market suffers from weak liquidity in trading volumes and asks the market observers where the liquidity has disappeared. We believe that the local markets do not suffer from lack of liquidity but suffer greatly from the weakness of confidence due to many factors affecting it. This is evident from the last report published The report pointed out that the volume of deposits increased from 1421 billion dirhams in December 2014 to 1627 billion dirhams in December 2017, an increase of more than 14.50% over the past four years, where the market witnessed declines and a peak at 5400 Point, if liquidity exists Which is very huge, but the crisis of poor confidence affects the behavior of traders, especially that the UAE market as I always described the market of individual portfolios controlling it compared to the size of institutional investment is modest and this is also one of the obstacles, where decision-making can be characterized by the lack of wisdom and control of influential societies on investor decisions and trends

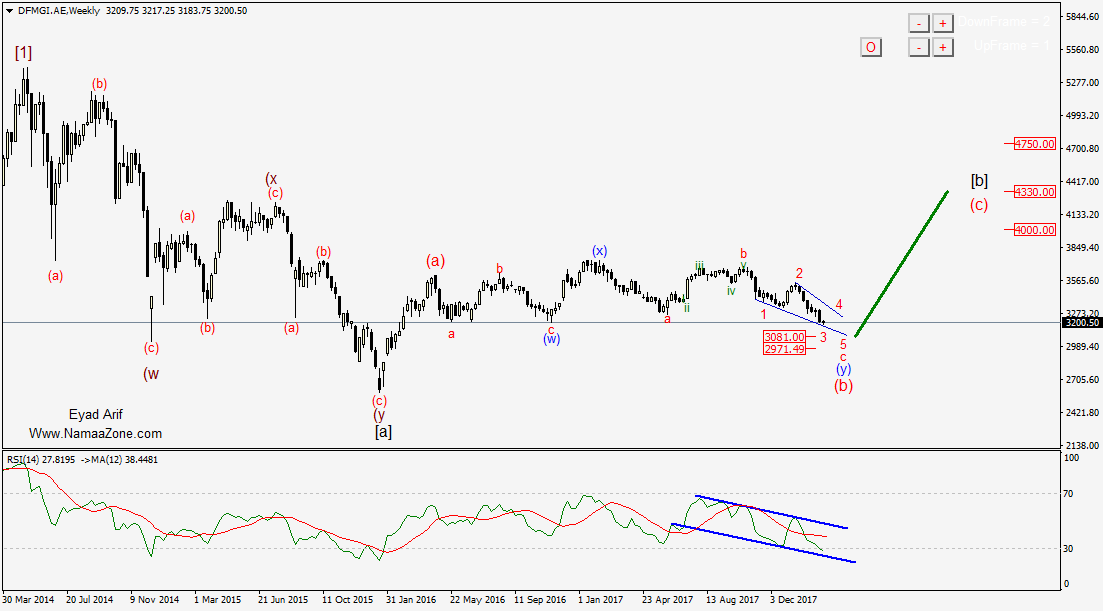

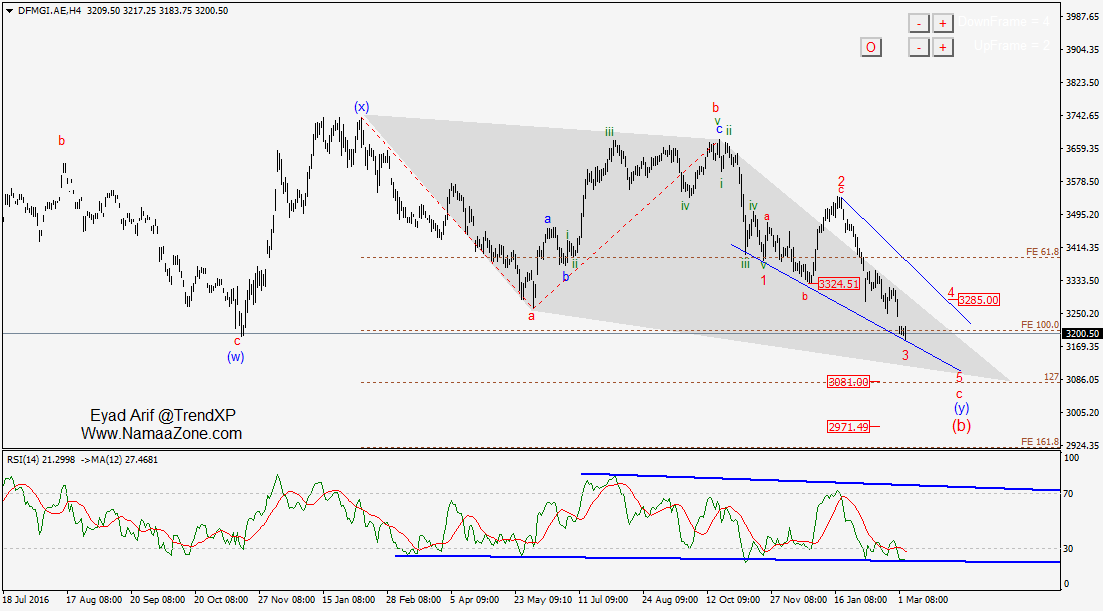

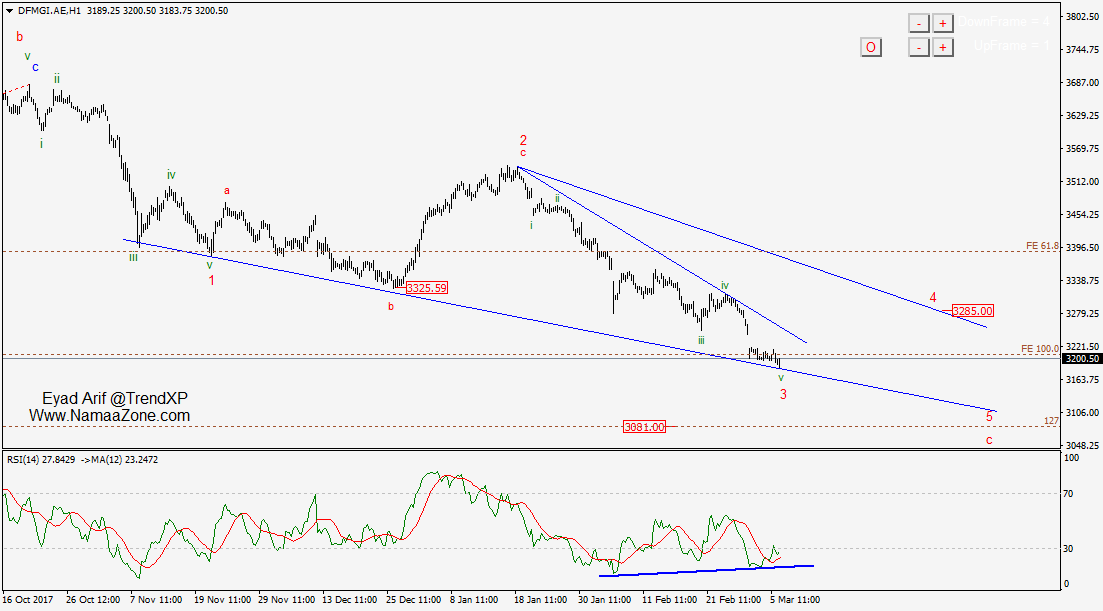

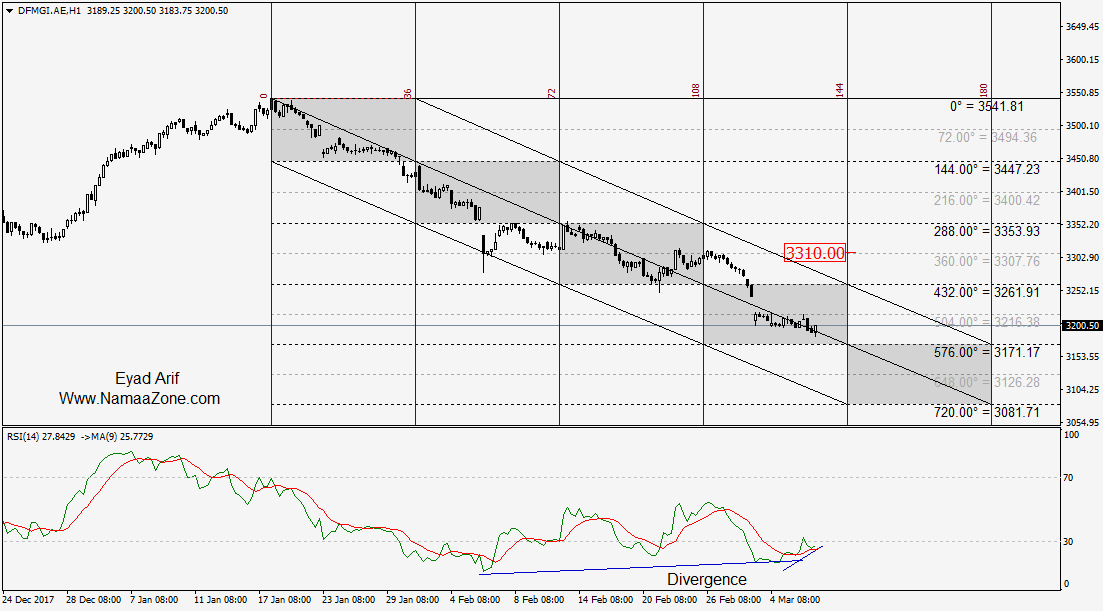

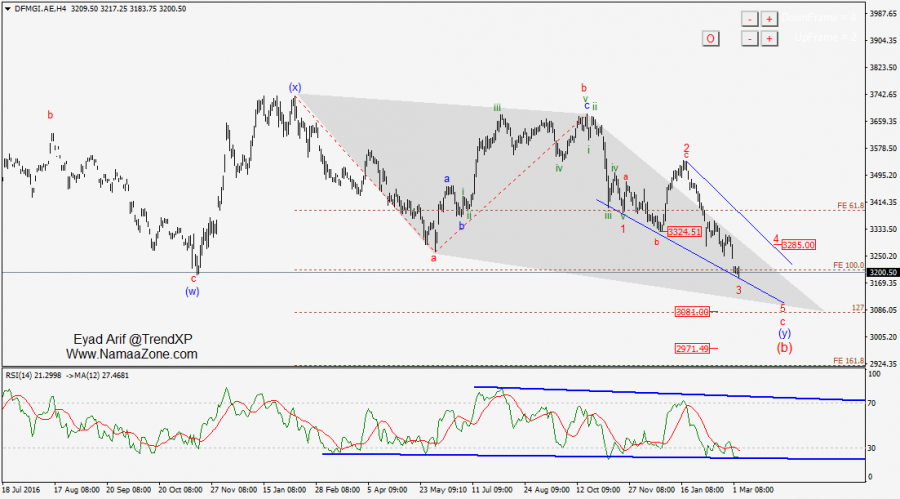

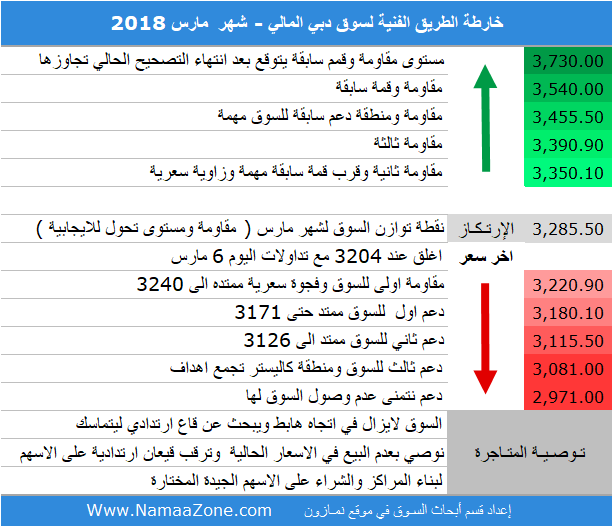

Technical Road Map for the Dubai Financial Market for March

General Vision

In the most pessimistic and frustrating times, we will be talking today in the March road map about an optimistic outlook that carries targets in the market to trade above 4,000 points, but reach 4750 points, and we believe as an overview that the market is exerting the aggregate pressure rather than the descriptive. The sale is over and it is strategic mistakes to sell at the current levels, since the continuation of the technical roadmap since 2006 knows that we always carry a different technical view and especially recommend selling when everyone accepts to buy in times of peak optimism and recommend buying in times of peak pessimism