This article is an extension of a series of important technical topics that I publish when we approach the end of bull market peaks, or when we reach the beginning of bull market bottoms.

You can review these technical topics in which I monitored the market peaks and troughs during the previous time cycles since 2018 until today, which carried my technical vision for the roadmap for the digital currency market, and I believe that we were among the successful ones over the past price cycles in discovering the peaks and troughs with high accuracy, thanks to God, and I warned people at the right time to avoid losses or alert them to the best time to invest to achieve profits. We ask God for reward in this world and the hereafter, and we ask you for good prayers.

The 2017 peak was spotted and the major correction from 20,000 to 3,000 for Bitcoin began.

Bitcoin hits 2020 bottom, starts rally from 6,000 to 50,000 target

Bitcoin's 2022 bottom has been spotted, and the rise from 16,000 to the 90,000 target has begun.

As October 2025 draws to a close and Bitcoin is trading at $115,000, there is a sharp division in the crypto community, with the majority believing the rally has more to come. They have several motivations, the most important of which, I believe, is the FOMO fears that always accompany peaks, as crowds rush to buy and smart money quietly exits before the storm begins.

At the same time, a few analysts believe that the current time is the end of the bull market and that extreme caution is required. In fact, this is what I have published on my Twitter account over the past weeks, raising awareness of the seriousness of the current stage when I announced last August, from the 124,000 level, my complete exit from the market and the liquidation of my portfolio, and that the current month of October 2025 marks the complete end of the upward cycle.

There are many technical reasons for Bitcoin's movement that made me take a warning position and announce my exit from the market. We will now discuss them in detail.

Time cycle

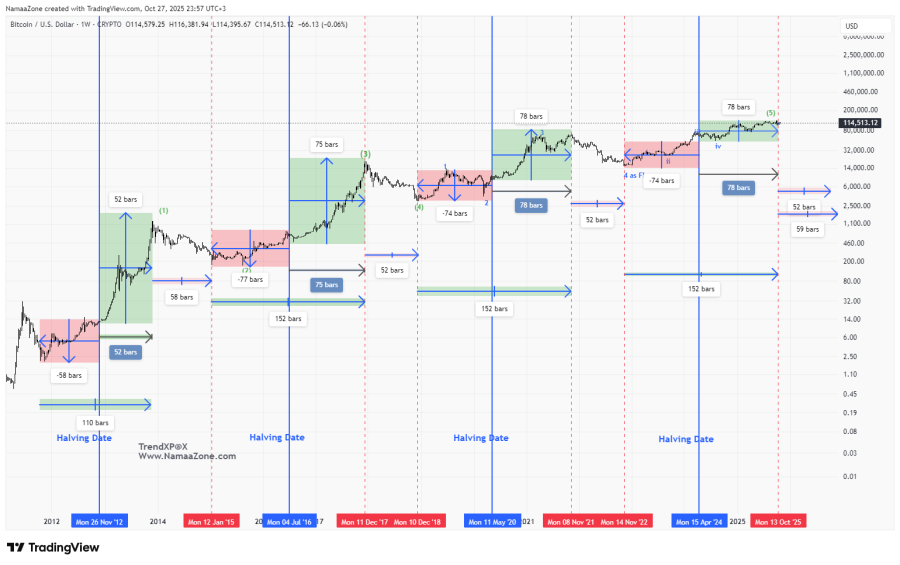

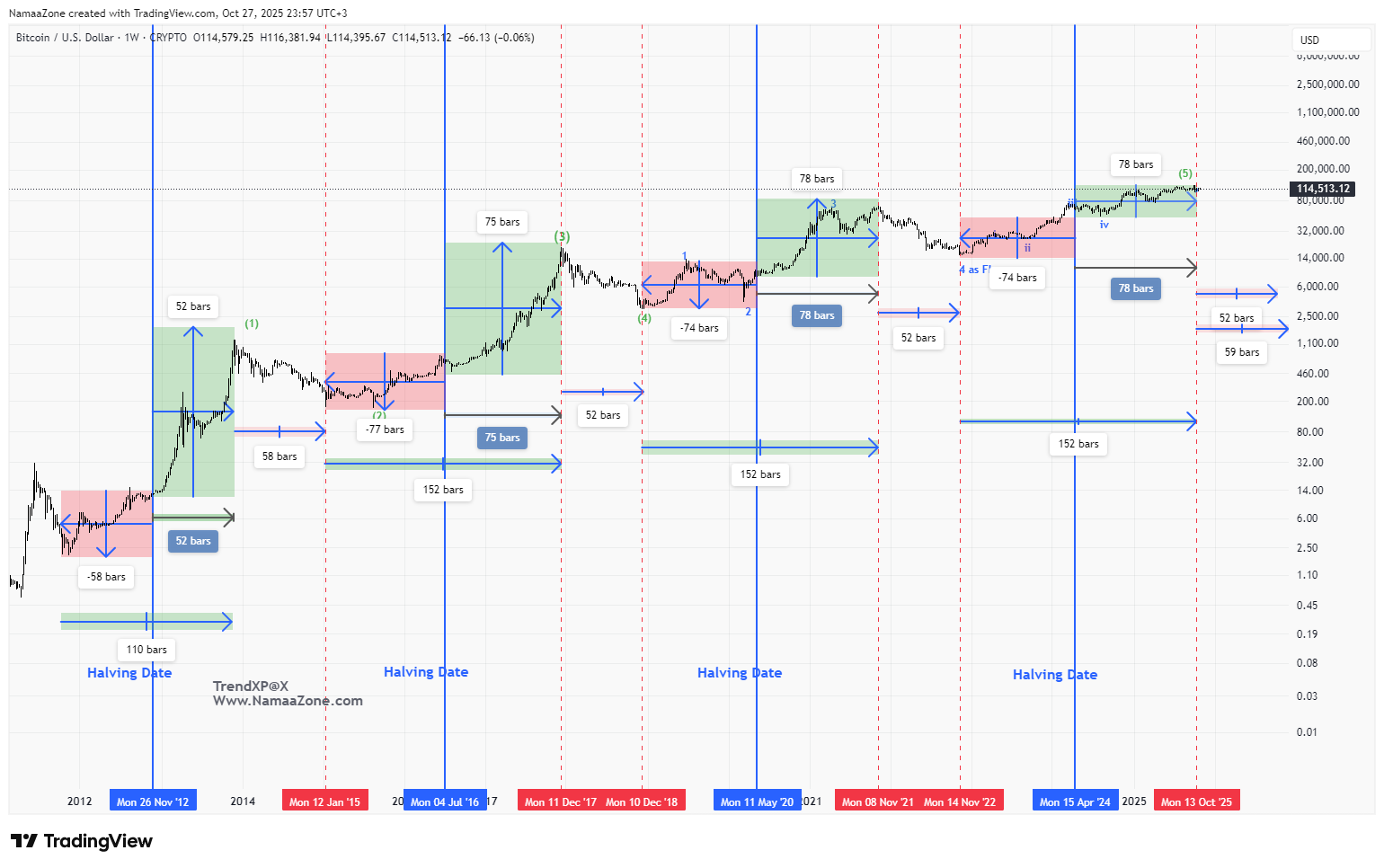

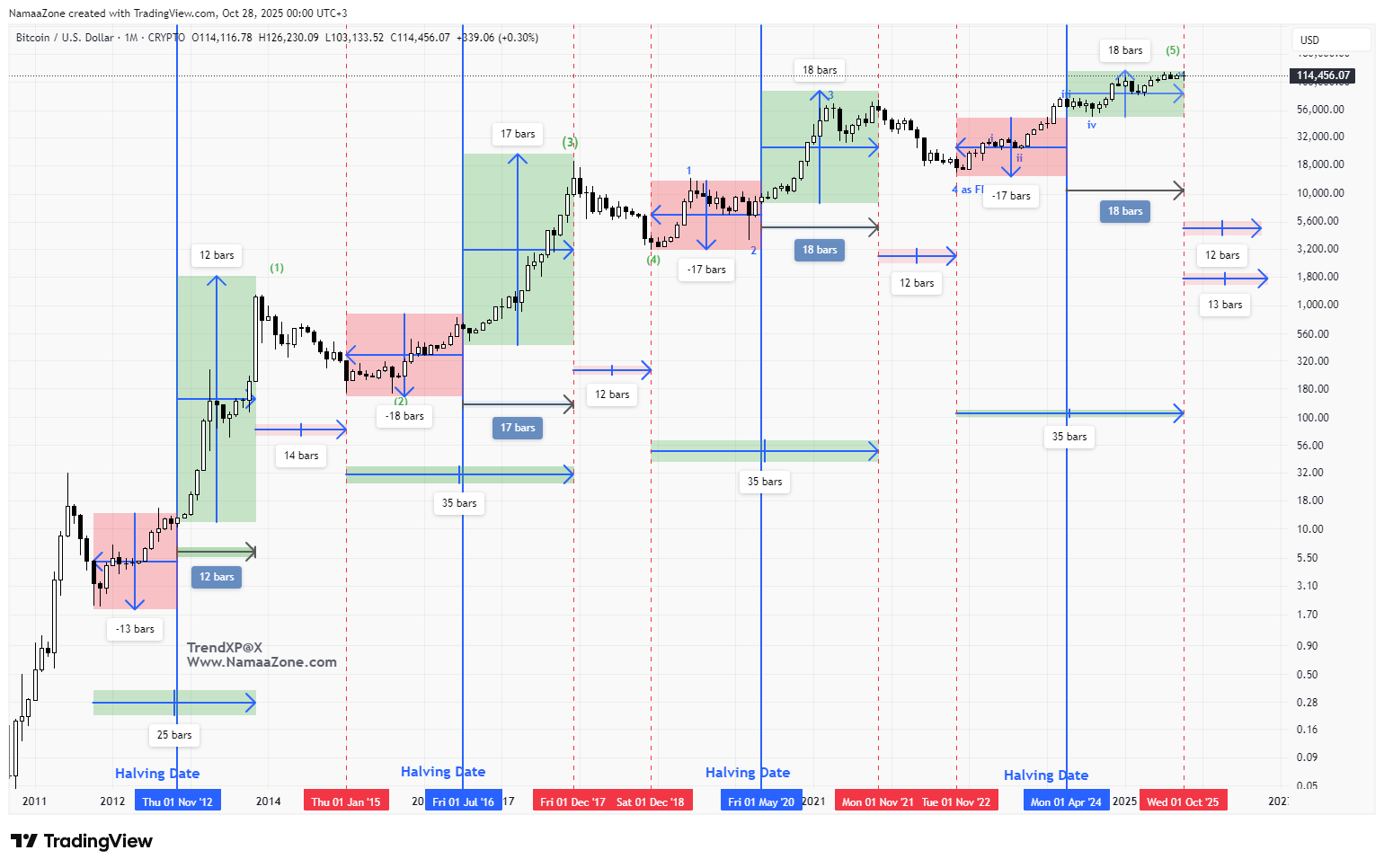

Perhaps, gentlemen, one of the most important innovations for humanity in the modern century is what Satoshi Nakamoto presented by inventing Bitcoin and using blockchain technology to achieve financial freedom between individuals and institutions in the new world. However, Satoshi also created a time cycle for Bitcoin and an important event that recurs approximately every four years called the halving, an event that affects price movement before and after the halving, forming a price cycle with strange precision, representing a recurring behavioral price pattern in all previous price cycles in 2012, 2016, 2020, and 2024, as prices tend to form a peak approximately 78 to 75 weeks after the halving, and achieve bottoms 74 to 77 weeks before the halving. Thus, the entire price cycle, from bottom to top, usually lasts approximately 152 weeks, or 35 months. Satoshi was not stupid, but rather extremely intelligent, knowing full well that prices do not move in straight lines and must rise and fall to create waves. And a constant movement, so he decided to be the maker of these waves, so he invented the idea of halving as an event that drives prices and a recurring pattern that some people know and benefit from, while others deny it and become firewood for the market.

Looking at the chart attached above on the weekly and monthly frame, you will find a strange time match for the price pattern in the 2016 cycle, the 2020 cycle, and perhaps most likely the cycle that is currently underway, 2024. All of these cycles extended for 35 months or 153 weeks, approximately, as the top is formed after 18 months of the halving and the bull market ends, after which the permact begins, which also extends to approximately 12 months.

We are now, gentlemen, as has become clear to you, at the end of the urine brand in October 2025, and thus my continuous warning over the past weeks had scientific support and evidence that I referred to a lot when talking about the time cycle.

Market fundamentals signals

There are several signals that we are watching that also suggest the end of the bull market and prompt the start of a major correction.

1- The diversity and overcrowding of financial derivatives in the market for buying over-crowded derivatives, which reached almost more than $80 billion, so any price or regulatory shock may stimulate a torrent of liquidations. This is actually what we saw on the day of the great liquidation on October 10, which showed us the fragility of the market and the speed of its collapse. There are no final figures yet for the size of the largest liquidation in the history of crypto, which some say reached $19 billion, while some saw this event as a mere conspiracy after which prices would rise again. However, in my technical opinion, it is a signal that cannot be ignored at this specific time in the 18th month after the halving, as it is a reversal in the general mood of smart money. In fact, on the following October 17, a lower bottom was achieved for Bitcoin, reaching 103,000.

2- Profitability indicators on the chain are at record levels SOPR / Realized profit, as the possibility of reaping harsh profits increases when the majority of the supply is at high profit levels for medium and long-term holders.

3- Changes in ETF flows. It is true that some reports indicate that institutional entry into Bitcoin exceeded 1.2 million Bitcoins, with a value exceeding $132 billion. However, this large intervention also creates a kind of imbalance in the flows and liquidity available for purchase during crises. It may also create significant pressure factors if the general mood changes towards selling fears.

4- Regulatory risks and sudden laws. Before going into this important point, let us first remember the direct impact on price movement when China banned trading and mining in September 2021, in a step that reflects great tightening that subsequently pushed prices to begin profit-taking and a price decline. In fact, now we must not ignore the European and American movement and efforts to impose laws and restrictions on digital currencies, such as the GENIUS Act and the Crypto MiCAR project. It is true that these laws and legislation, in one way or another, pushed digital currencies to move from a state of complete denial, as in previous cycles, to a state of acceptance and extinguishing legitimacy. However, efforts are underway from many entities, such as the SEC, to adopt investor protection policies, transparency, and impose regulatory restrictions. A market the size of the crypto market cannot continue in the current state of chaos in issuing and printing digital currencies that have exceeded 23 million different currencies. I am not exaggerating when I say that more than 99% of them are fake projects and mere white papers that carry no real value or addition.

5- There's also a strange correlation I've noticed, which is the coincidence of massive hacks on major platforms with bull market peaks in previous cycles. For example, the Coincheck hack in January 2018 came immediately after the peak, with $534 million stolen, immediately followed by several major attacks on BitGrail, Coinrail, Bithumb, and Zaif Bancor. Also, in August 2021, Poly Network suffered a $600 million theft due to the exploitation of weak bridges. There's also a striking recurring pattern driven by several factors, including abundant liquidity and high asset values that made hacking tempting, as well as the reckless adoption of new bridge and DeFi technologies, such as bridges and smart contracts, without adequate security gaps. At this point, a big question arises: Which platform is the next likely to collapse or be hacked at the end of the current bull cycle? Or can the major liquidation strike on October 10 be considered an unprecedented historical event, indicating a breakthrough through the tens of billions stolen in a quasi-legal manner that cannot be questioned!!

Technical and wave analysis

As in the chart attached above and the numbering I adopted, see that we have from the bottom of 15,000 in November 2022 until the top of 126,000 in October 2025, five upward waves are formed on the medium-term frame with consistent internal structures. Therefore, this technically suggests that we are actually approaching the end of the bull market.

In addition, we have a departure from the general upward trajectory of the ascending channel, and we also notice negative divergences on the weekly and daily framework that appeared at the top of the third wave in April 2024 and continued throughout the formation of the current fifth wave until October 2025.

Important point

Now, by looking at and analyzing the entire movement of Bitcoin on the weekly frame from 2010 until now, through all the previous halvings, peaks and troughs, I believe that we are facing the formation of five clearly defined upward waves.

So the big question is whether the expected correction will stop at the end of 2026 as usual as a good first scenario, or will we be facing a deeper and more difficult correction different from the usual one that extends to correct the entire price movement from the bottom of 2010 as a bad second scenario. The answer is not easy, but determining the scenario depends on the bottom of the 15,000 level. If it is broken in the next bear market, then I believe the decline will extend to 2027 and perhaps 2028 within the second scenario.

Currently and with today's trading, October 27, 2025

Bitcoin is trading at 115,000. I believe we have achieved a five-part decline from the October 6 peak at 126,000 to the October 17 bottom at 103,000. Therefore, I see the current rebound so far as a three-part corrective structure that may extend to $117,300, forming a descending peak and a second wave peak, followed by a continued decline towards the 85,000 and 70,000 levels for Bitcoin.

I know this may sound scary to many, but what I'm talking about has been seen before, my friends, in previous Bitcoin cycles. We all saw the drop from 65,000 to 15,000 in 2022, and also from 20,000 to 3,000 in 2018, and also from 1,242 dollars to 166 dollars in 2014. All of these corrections were harsh and painful, but in the end, they brought more investors to the market and later brought the rise to a new historical peak.

Therefore, expecting a decline now from the 120,000 levels and the beginning of the bear market and reaching 30,000 is not outside the framework of logic and may be a rational view of historical events.

But isn't there hope for this expected final rise? The problem is that everyone has the same idea. Everyone knows that there is a dangerous atmosphere coming that could form a peak, but everyone is hoping for the final rise for the final escape, which if it happens, the market will not go far. Therefore, my negative view towards digital currencies will remain fixed, that we are in selling areas, not buying areas, and the warning flag will remain raised until proven otherwise.

The important question is where do I expect the bear market to end and the next Bitcoin bottom to be?

Actually, no one knows or can be certain yet, but I think the next Bitcoin bottom will be between $30,000 and $25,000 at the end of 2026 if we are in the good scenario. However, if we are in the difficult scenario, which is a complete correction from the 2010 bottom, then I think the next Bitcoin bottom will be between $15,000 and $10,000, and then the correction will extend to take a longer time period than the usual 12 months for the downward cycle.

Which digital currencies do you expect to have a good future and can be accumulated when they reach the bottom?

An important question, but the answer will be complex and long and depends on whether we will face the first scenario of reaching 25-30 thousand or, God forbid, the second scenario of 10-15 thousand.

In any case, we have become accustomed to the presence of new heroes and new surprises throughout the Bitcoin cycles, but one hero has always remained constant in the field, and that is Bitcoin. In my opinion, if we remain above 25,000, Bitcoin will remain the star, in addition to a limited number of leading currencies such as Ethereum and Solana. However, if God forbid we break the 15,000 level, then the situation may be completely different, and we may be facing a comprehensive restructuring of this market. Yes, Bitcoin will remain, but millions of fictitious project currencies will evaporate, and then we may see the return of the Total3 Market Cap below the $100 billion level. Then, only those who truly deserve to remain will remain in the market. Then we may see who will compete with Bitcoin for leadership in the second round of the super cycle for the market in general.

Best wishes to all

Ayad Aref

Founder of the Namazon economic platform