Another volatile gold saw another Friday, as the outbreak of the Corona Virus still dominated the market. Although the trading range included around $ 50 on Friday, gold closed today just above the opening levels. The US dollar and stock market tried to recover on Friday during a choppy session. However, it closed the day again on risk aversion with gold trading at positive levels and Wall Street falling despite the better-than-expected NFP data set.

The state of emergency was declared Friday in New York while the number of new cases of the virus continued to escalate in the United States. On the other hand, Italy is experiencing more stringent closures, as Giuseppe Conte, Prime Minister of Italy, signed a decree severely restricting movements in the Lombardy region - including Milan - and other northern provinces, where the government is trying to stop the spread of the Corona virus.

>The government banned entry and exit from Lombardy and closed cinemas, theaters, gyms, bars and discotheques. Funerals and weddings are also prohibited. Nicolas Zingaretti, the leader of the Democratic Party of Italy, announced on Saturday that he has been confirmed with the Corona virus.

The number of new cases of Coronavirus Covid-19 is approaching 6000, and the number of deaths has reached 223. Reports began of the first cases in other countries in Europe, along with a rise in the number of deaths in Iran, including government officials. As governments around the world try to limit public gatherings, Saudi Arabia has temporarily suspended visits to Mecca as well. On the data front, markets will focus on Wednesday on CPI data in the US, as it has direct effects on the Fed's monetary policy and the US dollar.

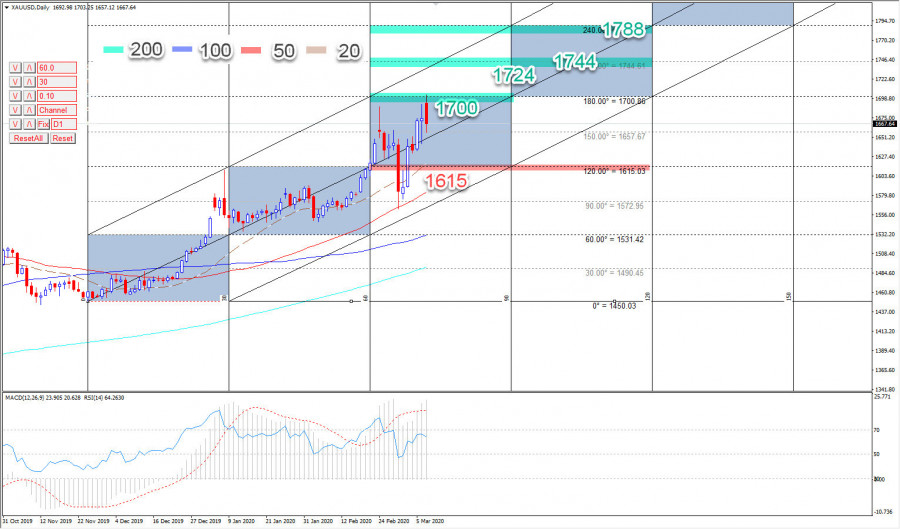

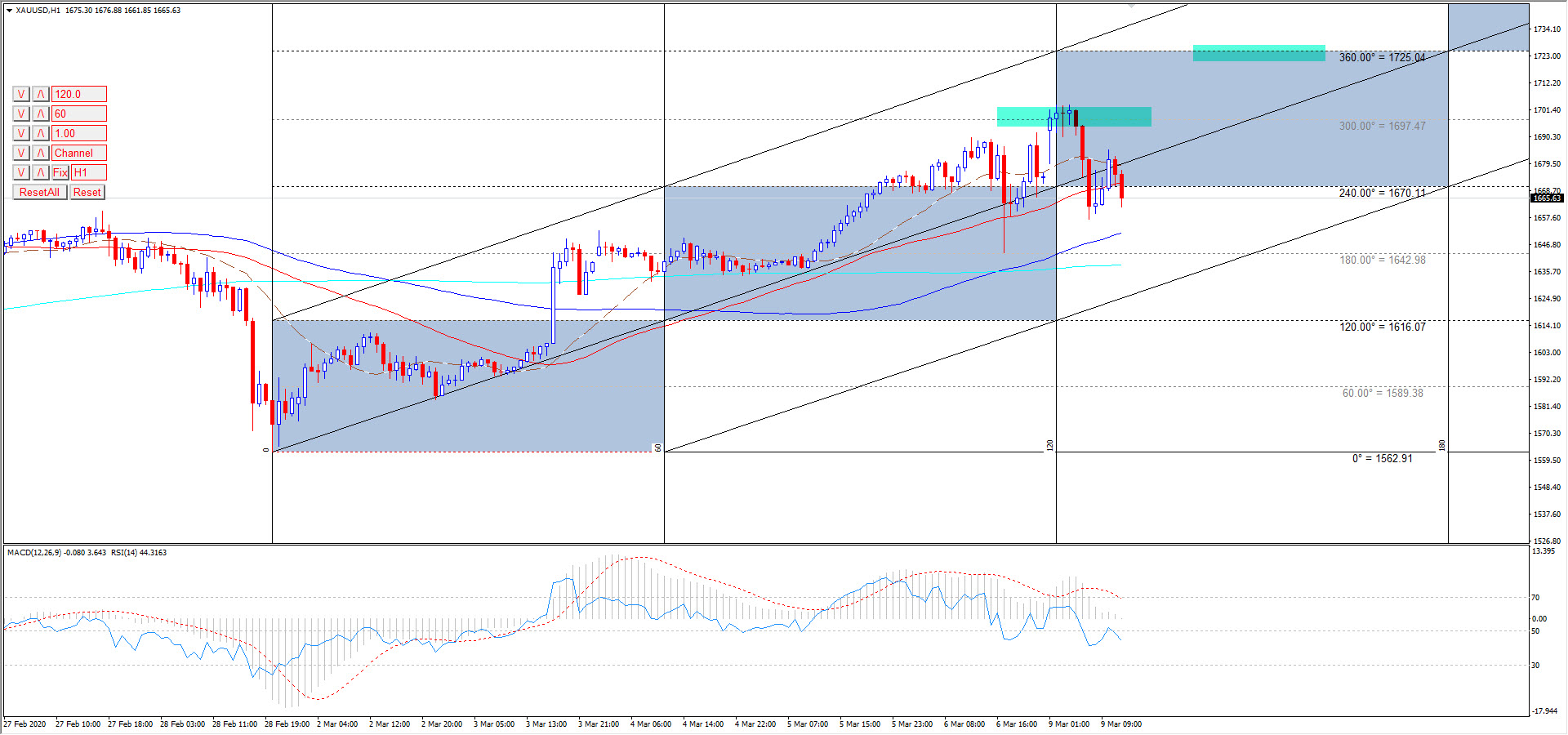

Technical outlook:

Gold is trading above the nearby support 1550-1560 to achieve its main target at 1700 levels. The outlook remains positive for the yellow metal by trading above these levels 1550 - 1560 and the possibility of visiting the regions of 1724 in the short term that the bulls succeeded in breaking through the barrier of 1700 dollars per ounce.

The overall picture of gold remains positive with trading above 1615 and it is possible to see levels 1744 and 1788, breaking 1615 opens the door to the possibility of targeting 1560-1572.