Was changing the name of Facebook to dead a bad omen??!!

The red color has dominated the stock’s performance since the American company announced almost a year ago the transition to the new name in the context of its desire to focus on metaviruses, and this came in conjunction with the specter of economic stagnation that haunts stock markets in general, to bring the social media giant out of the top 10 list. Companies by market capitalization in the world.

Turning to the name Meta to be the parent company of all of its applications, Facebook wanted to change its skin and improve its reputation, after the numerous accusations related to its failure to maintain the privacy of users as well as the failure to moderate content, and at the same time, it wanted to expand its business and focus on virtual reality, This has raised investor concerns about the huge costs that the company will need for the transformation.

Unfortunately, Facebook entered this new phase in a difficult economic and political environment. The Russian-Ukrainian war exacerbated the high rate of inflation, which forced the central banks to intervene quickly to stop the increase in prices by raising interest rates at a large and successive pace, which raised fears of an economic recession. Which cast a shadow on the performance of the stock market in general, and of course the Facebook stock, which we will explain in detail in the following lines:

Heavy losses per share

In early September 2021, Facebook's market capitalization rose to an all-time high above $1 trillion, ranked sixth globally and fifth among American companies over $1 trillion, but the scene looks a lot different at the moment as it currently has a market capitalization of $365 billion, down 65 %, which made Facebook 11th among the largest companies in the world, so what happened?

Facebook's stock hit a record high on September 7, 2021, above $378, and has taken a downward trajectory since then, after the financial performance became less than expected, amid increased competition and weak advertising sales, due to economic pressures, in addition to criticism of a business model. company.

But the significant regression in the Facebook stock curve was in the last February 3 session, when the stock plunged more than 26% in the largest daily drop ever, recording $237, not only that, but the American company lost more than $230 billion in one session, to be The biggest drop in market value in a single day in the history of the US stock market, which pushed Facebook out of the top 10 list at the time.

Facebook stock performance in 12 years

This came after Facebook announced disappointing financial performance in the fourth quarter of 2021, noting that it incurred a net loss of $ 10 billion in the whole of 2021, due to its investments in Metaverse, with expectations of spending on this sector pressing on the overall profits of Meta.

And what increased the clouds over the company’s performance in 2022, CEO Mark Zuckerberg’s warnings that increased competition may negatively affect Facebook’s profits, especially in light of the growing use of applications such as Tik Tok, which people are spending their time on more than the social networking platform, and this of course affects In the company's share of advertising.

And before the Facebook stock regained its strength from this big loss, fears of economic recession increased after the Federal Reserve started the monetary tightening cycle aggressively, which hurt technology companies in particular, and these pressures, in addition to the disappointing profits, continued to affect the performance of the stock until now.

Facebook’s stock ended last September with losses of more than 15%, bringing the stock to its lowest level since early 2019 at $135.68, with reports that the company announced a plan to cut costs last week, which raised its losses since the beginning of this year to almost 60%, to become among the worst 5 performance stocks in the Standard & Poor's Index during 2022.

With these losses, Facebook again came out of the list of the 10 largest companies in the world by market value, after losing almost two-thirds of its value from the peak of September 2021, to come in 11th place behind Apple, Aramco, Microsoft, Alphabet, Amazon, Tesla, Berkshire Hathaway, United Health, Johnson & Johnson and Visa, respectively. .

Factors affecting the performance of Facebook stock

There are many pressure factors that have harmed Facebook's stock this year, some of which relate to the company's performance and future, and others are related to general matters that negatively affect stock market movements, especially high interest rates.

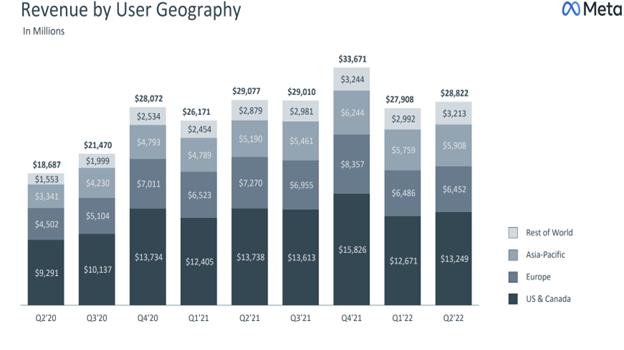

Facebook left a bad memory in the last announcements of the quarterly earnings season, as the American company recorded the first quarterly revenue decline in its history on an annual basis during the second quarter of 2022, to reach $ 28.82 billion, compared to $ 29.07 billion in the same quarter of 2021, as the graph shows. next one:

The company also expects the disappointing performance to continue in the third quarter, as it estimates a decline in revenues for the second consecutive quarter to range between 26 and 28.5 billion dollars, which is less than analysts’ expectations of 30.3 billion dollars, which reflects the continued weak demand environment for advertisements with no Certainty on a broader macroeconomic level, especially in light of increased competition from other applications.

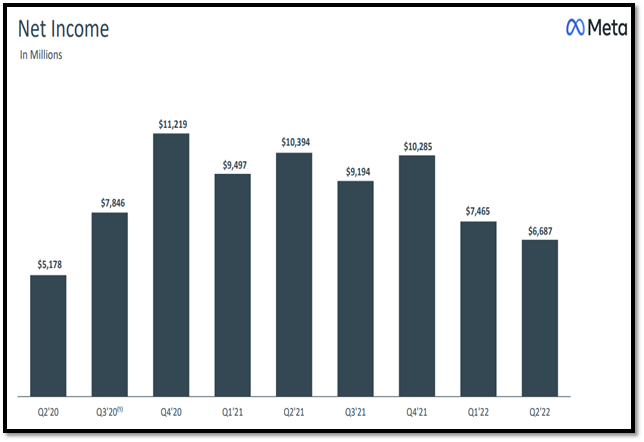

As for net profit, it fell to its lowest level in two years, recording $6.68 billion ($2.46 per share) during the second quarter of 2022, compared to $10.39 billion ($3.61 per share), as the following chart shows:

It is expected that this poor financial performance will continue in light of the increased investment in the Metaverse business, which Facebook sees as the future of the company, but will cost it billions of dollars annually until it then becomes an important source of revenue, and this is reason enough to make investors not enthusiastic about the stock, at a time when competition is increasing. With other applications that have attracted a good number of Facebook users.

As for the factors that affect the US market in general, fears of economic stagnation have become the bogeyman of the stock market, with the Federal Reserve continuing to raise interest rates for the fifth time in a row to reach the range of 3% and 3.25%, after it was near zero before March Past.

Technology stocks are more sensitive to higher interest rates, because the future profits of big tech companies will not be as much as they were when interest rates were lower, and higher interest makes financing more expensive, which affects a company like Facebook that needs to borrow heavily to finance business metaverse.

As for technical analysis,

The chart tells us that the decline process from the August 2021 top from the $384 level has taken the form of a five-fold impulse, and this means that it will continue to stay for a very long time below the barrier of the historical top with the start of the major price correction cycle for the stock, which may extend to the targets of $96 through the $118 support level, with the possibility of To see triple technical bounces that bring us back to the level of 220 dollars, followed by a return to the general bearish path, to reach the previously mentioned goals.

In the end, amid all these pressures, Facebook's stock is no longer a growth stock as it was before, so will Zuckerberg win his bet and the company will come back strong in the future?

Iyad Aref

Founder of the economic site Namazone